The Greatest Show of Them All

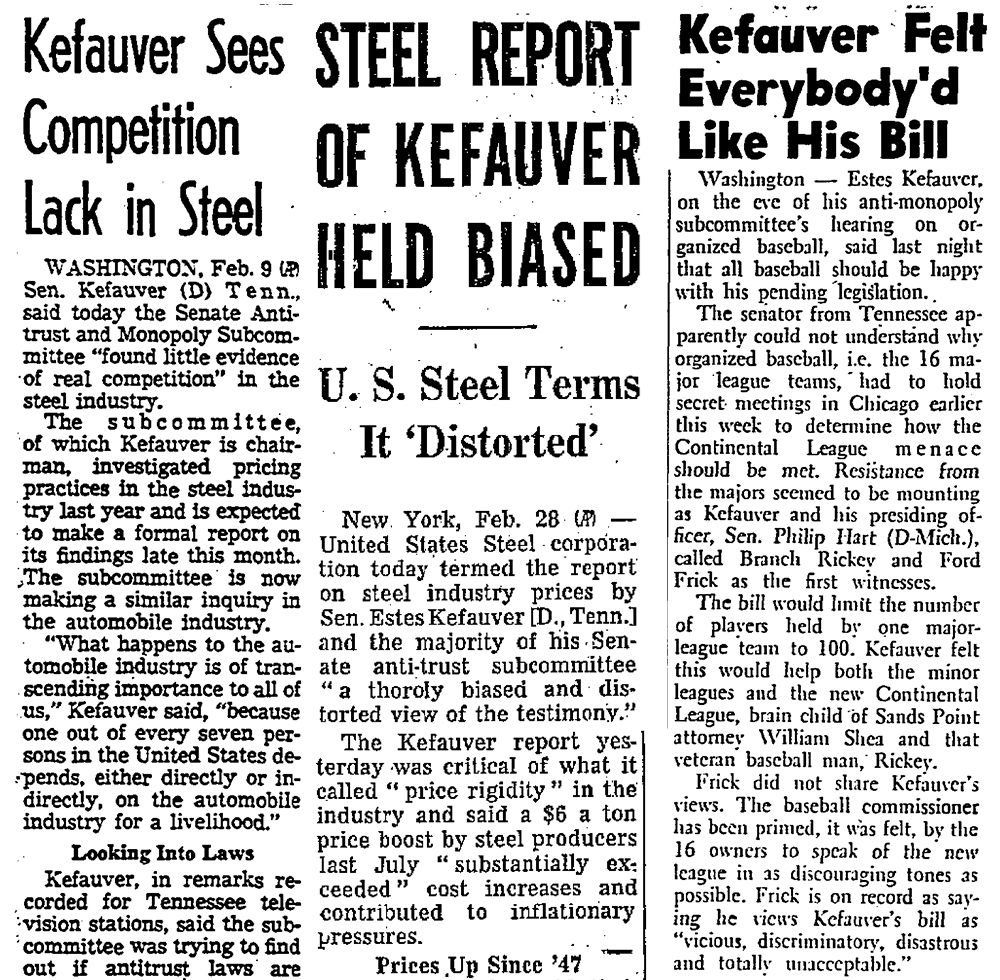

In August 1957, Senator Estes Kefauver, chair of the Senate Subcommittee on Antitrust and Monopoly (established in 1951), grilled U.S. Steel president Roger Blough in room 457 of the Old Senate Office Building. The previous month, the steel industry had announced a $6-per-ton price hike.

Kefauver: Mr. Blough, do you regard it as true competition when another company matches your price to a thousandth of a cent per pound…Wouldn’t it be more competitive if there were at least some slight difference in these prices?The testimony of Blough and fellow steel executives solidified the New Deal Democrat’s reputation as a monopoly hunter. To understand and, ideally, ward off what Supreme Court Justice Louis Brandeis called the “curse of bigness,” Kefauver corralled Blough and others to assess the role of administered prices—prices that firms set internally, not through market forces such as supply and demand—in the rising cost of living. The progressive, coonskin-cap-wearing senator from conservative Tennessee saw the lack of market controls as “a built-in immunity to the forces of the market” that benefited industry, not consumers.

Blough: I would say that the buyer in that situation has this choice. He chooses to buy from one company at $5 higher. He chooses to buy from our company at $5 lower. Now if you call that competition and a desirable form of competition, you may have it your way. I say the buyer has more choice when the other fellow’s price matches our price.

Kefauver: That’s a new definition of competition that I have never heard.

The time was ripe to reflect on the power of big—and growing—businesses. Seven years earlier the senator had passed the 1950 Celler-Kefauver Act, which closed asset loopholes for horizontal mergers that eclipsed Section 7 of the Clayton Antitrust Act of 1914. The legislation prevented executives from buying the assets of companies they wanted to acquire. It was an update of the Sherman Act of 1890, which prohibited contracts, combinations in the form of a trust, and conspiracy in restraint of trade. Chief Justice Earl Warren later wrote that the Celler-Kefauver Act was intended to stop the “rising tide of economic concentration in the American economy.” Yet the legislation indirectly encouraged the growth of conglomerates because court battles over the act led to Supreme Court decisions that watered it down.

The chairmen of the nation’s biggest companies, including Bethlehem Steel, Chrysler, Ford, General Electric, General Motors, Merck, and Standard Oil, gave dramatic testimony at the hearings. Dozens of economists, including former Fortune editor and Harvard University professor John Kenneth Galbraith, testified as to whether price increases led to inflationary markups and higher margins. The press regularly covered the subcommittee both as serious inquiry and as theater. Kefauver was portrayed as a maverick pitted against the likes of Blough. Despite a number of adversaries who tried to quash him at every opportunity, a segment of the public adored Kefauver, who, as a presidential candidate in 1952, was the first to beat an incumbent president in a New Hampshire primary.

The hearings drew a celebrated list of witnesses. Eleanor Roosevelt gave evidence on hearing-aid manufacturers. Sonny Liston, Mickey Mantle, and Ted Williams testified about monopolies in boxing and baseball; at the time both had a reserve clause preventing players from working for different teams during their contracts. In a telegram to Representative Emmanuel Celler, chair of the subcommittee’s House counterpart, Frank Sinatra testified that he moved to Capitol Records after an executive at Columbia Records had presented inferior songs controlled by BMI, later deemed a monopoly, instead of songs from the American Society of Composers, Authors, and Publishers catalogue. “It is my earnest hope that your investigations will result in the curbing of practices which create restraint and take from the artist those creative freedoms which are so necessary to his talent,” he wrote.

The subcommittee’s first test was steel....MUCH MORE