Shipping: Maersk Warns 2019 Global Economic Outlook Is Worse Than 2018

Lifted in toto from

ZeroHedge:

Denmark's shipping Maersk is the world's largest shipping company, and

it is thus safe to say that what it sees in terms of global trade is

indicative of real trade conditions around the globe. Which is bad news,

because in an interview with Bloomberg TV on Thursday, shortly after

reported dismal earnings, CEO Soren Skou said the global economic outlook for this year is looking bleaker than in 2018, which is affecting his business.

Skou said other factors impacting Maersk include the rising oil price,

which affects input costs, adding that he sees no good reason why the

price of oil might drop.

The reason behind Skou's pessimism is that trade tensions had led to a lot of front-loading of trade in 2018, and that effect is now disappearing, which

means that the fallout of trade tensions will be far bigger this year,

even as the balance between supply and demand in the industry is

improving.

Earlier in the day, Maersk reported full year earnings, with the

company's forecast EBITDA for 2019 understandably, coming in weak, and

in fact the guidance missed the lowest analyst estimate, and now sees

2019 EBITDA of only $4 billion, far below the consensus estimate of

$4.77 billion (range $4.11 billion to $5.40 billion).

The historical data was mixed, with full year 2018 EBITDA printing at

$3.81 billion, below the $3.83 billion expected, while revenue of $39

billion was slightly above the estimated $38.82 billion; meanwhile the

company's underlying profit was $220 million, also below the estimate of

$291.1 million.

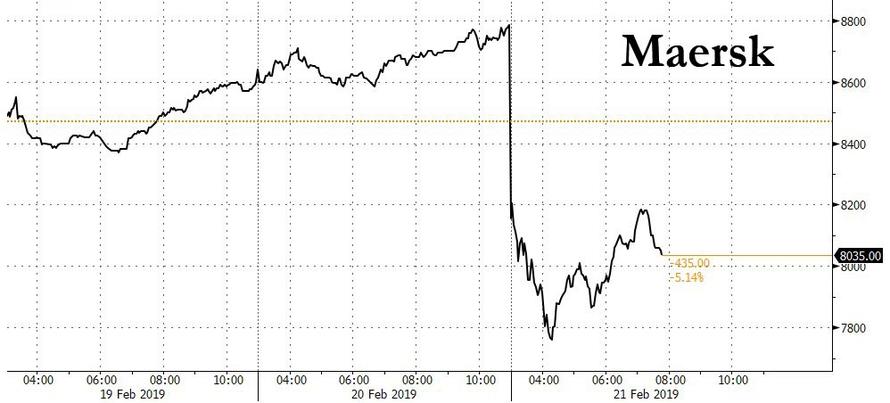

As a result, the company's stock tumbled as much as 10%, before

stabilizing down 8.6%. The drop was the biggest one-day plunge in Maersk

stock since June 2016.