Glencore plans new buyback as trading profit disappoints

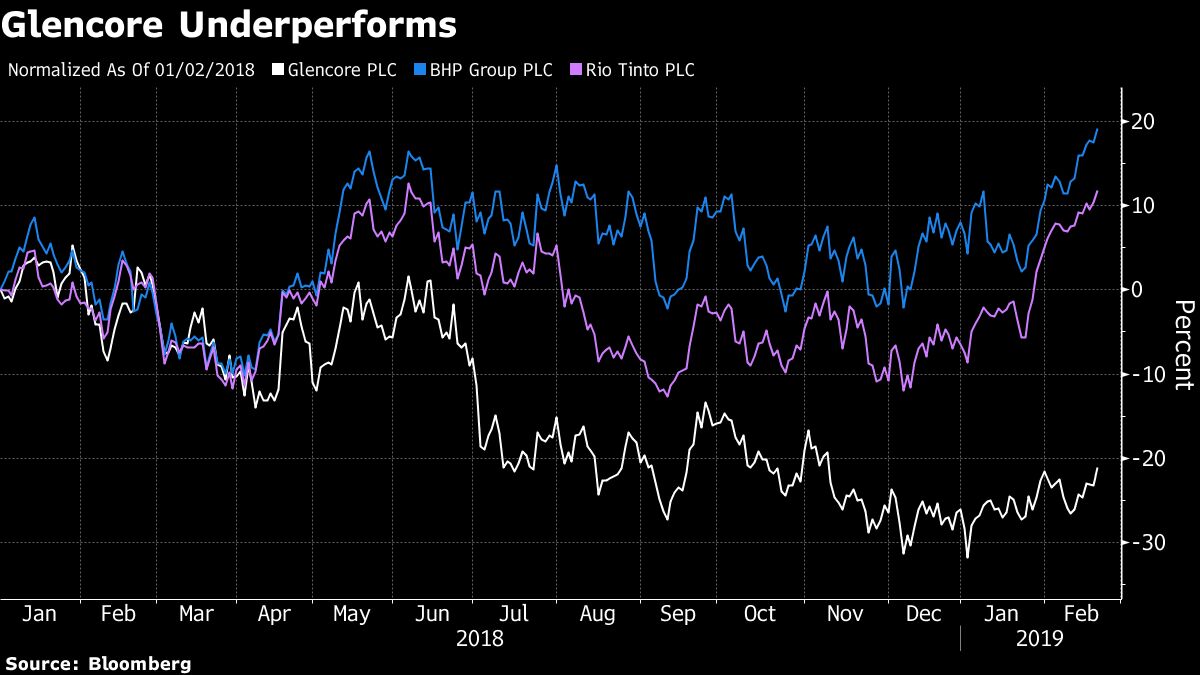

Glencore Plc reported its weakest trading profit in five years and missed analysts’ earnings estimates, even as the mining giant promised to increase its rewards to shareholders after a tough year.

The disappointing performance in the trading unit is a blow for Glencore, which has always said its traders can make money in any kind of market. The company touts the unit as a differentiator from other big miners, cushioning the ups and downs of the commodities cycle.And Henry Sanderson at the Financial Times 20 Frbruary:

Glencore’s shares declined even after it announced a new $2 billion buyback program and said it plans to return another $1 billion after selling non-core assets over the course of this year. The commodities giant also pledged to cap coal production in response to investor pressure for action on climate change....MORE

Glencore’s Glasenberg says cobalt close to bottom after price drop

Cobalt prices are close to a bottom and set to rise as battery makers look to secure long-term supplies to meet rising demand for electric cars, according to Ivan Glasenberg, the chief executive of Glencore.The current futures curve says that's not happening, yet:

The price of cobalt has fallen by 40 per cent over the past three months, following a surge of supply of the metal from the Congo and a pause in buying by battery makers.

But Mr Glasenberg said the market could be short of supply again after 2020 due to increased sales of EVs and re-stocking by battery makers.

“It seems like it’s bottoming out,” Mr Glasenberg said. “People are destocking in China and they will have to come back into the market and start re-stocking. By 2020 we believe the demand will be there due to more electric vehicles.”...MUCH MORE

LME

Cobalt traded at 31,000 on Wednesday February 20. Historically, Cobalt reached an all time high of 95250 in March of 2018 and a record low of 21750 in February of 2016.—Trading Economics