Three parts, first up World Maritime News:

A failure to recover the extra fuel costs in full may result in bankruptcies in the container shipping industry, international shipping association BIMCO said.

As the starting line for the International Maritime Organization (IMO) sulphur cap approaches, the dominant shipping theme of 2019 will be the sharing of the higher costs that are expected in various forms towards the end of the year, according to the association.And from BIMCO, February 19:

These extra shipping costs will come either as a result of purchase of fuels, which are more expensive than heavy sulphur fuel oil (HSFO), or investments in abatement technologies that will allow carriage and consumption of HSFO.

As explained, profit margins in this shipping industry will be reduced everywhere unless these costs are passed on to the end customer through the whole supply chain. According to BIMCO, the ability of container shipping to pass on increases depends on its negotiating power and a fundamentally strong freight market.

Moreover, BIMCO said that the gloomy outlook in container shipping seems certain for this year and is likely to be extended.

Containerized imports in Europe look likely to be stuck with demand growth of no more than 2% for years to come. That means the long-hauls into northern and southern Europe, where ultra large containerships are perfectly suited to reap the benefits of economies of scale, will suffer unless cascading is accelerated.

As the US East Coast ports are now fully equipped with cranes to cater for ultra large containerships, the nation saw strong import growth into the US via this route in 2017 (10%) and again in 2018 (8%). More cargo is likely to follow this trend, away from the more crowded options of the US West Coast. Despite this, BIMCO forecasts overall imports into the US will be lower in 2019 when compared with 2018....MORE

Container Shipping: The many pitfalls in the coming months will decide the fate of the year

Overview

European containerised imports look likely to be stuck with demand growth of no more than 2% for years to come. That means the long-hauls into northern and southern Europe, where Ultra Large Containerships are perfectly suited to reap the benefits of economies of scale, will suffer unless cascading is accelerated.

Demand drivers and freight ratesThe long-haul mainlane trades, which are critical for the overall health of the container shipping market, are in for what could become a tough year with several pitfalls. Trade tensions between the US on one side and China and Europe on the other, are coming in on top of a tendency for traditional consumers of containerised goods in the West to show signs of being ‘saturated’ – at least in Europe it seems. If this tendency is here to stay, very real problems will prompt liners to rethink their strategy – not just cause, yet another update of the network.

Lower demand on mainlane trades is also likely to have an impact on the part of intra-Asian trade lanes that benefits from exports to Europe and North America.

February is a slow month and this year will be no different. The only real question will be, to what extent? Growth in the first 11 months of 2018, was the slowest recorded in the past decade for intra-Asia at 3.8% (Source: Clarksons), except for 2015 when the global market was hurt by a weak demand growth rate.

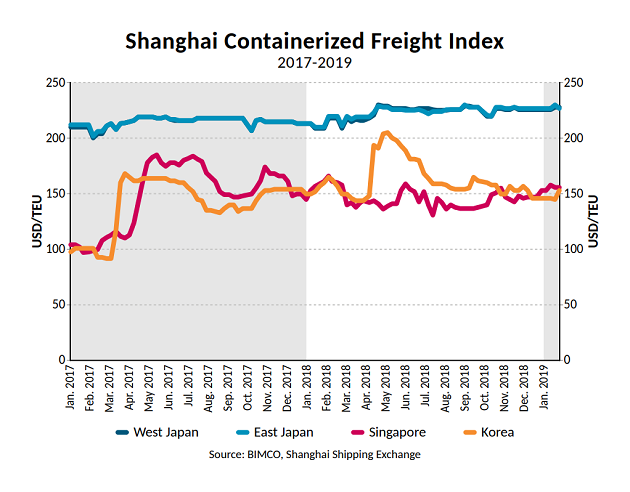

Freight rates on many intra-Asian trades have been steady throughout 2017-2018, which is very positive in a market which is growing at continued slower pace. The big question remains, how steady will they be, going forward when extra-Asia trades weaken?

Will intra-Asian trade lanes, supported by the regional demand for container shipping continue growing at a pace that will be high enough?

In addition to the freight market, the time-charter market also demands attention. Not only because the misery of 2016, when rates were hugely loss-making and demand was very limited, is behind us, but because 6,500 TEU and 8,500 TEU ships are experiencing improved interest from operating liners. Why? They fit well in solidly growing north-south trades, delivering scale and flexibility into any non-main trade lane. Moreover, we haven’t seen many new ships of that size built in the past five years. And, note too, current charter rate levels are still loss-making for these ship sizes.

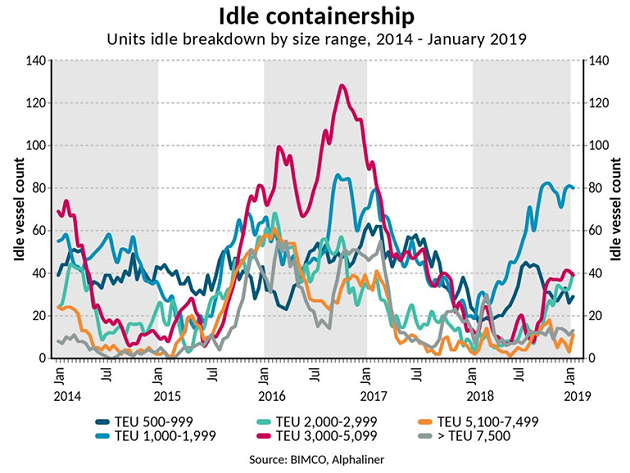

If we compare the development in charter rates with the data on idle containerships, it becomes interesting, as a relationship seems to exist.

What lies ahead? Some support to charter rates where the idle fleet is already low (ships with a capacity above 5,100 TEU) and, in the case of a noticeable reactivation among the sub-5,100 TEU sectors, time-charter rates could be lifted there too....MORE

The sequence is this: charter demand picks up; reactivations start; and, as the idle fleet comes down, the apparent shortage of open ships for hire lifts charter rates. However, there are no clear signs yet of a significant reactivation trend – or the opposite – that could trigger rates to move in the time-charter market.

Fleet news A fleet growing at too high a pace – as was the case in 2018 – has never done anything to boost the profitability of a shipping market....

Also at BIMCO, Feb. 20, tankers and bulkers:

Tanker Shipping: Geopolitics and overall fleet growth are the main drivers

Dry Bulk Shipping: Uncertainty mounts against a backdrop of weaker growth in Chinese imports

We saw similar concers raised last June as the impacts of the IMO's low sulfur fuel requirements were being comprehended:

Shipping: CEO of Third Largest Fleet Says "We're All Going to Go Bust"

They move a lot of stuff and are a major player and that's what makes this comment so noteworthy....