From VoxEU, October:

The Bank of Japan has bought massive quantities of Japanese stocks in a bid to increase aggregate demand and inflation, and to encourage Japanese savers to take on more risk. This column surveys the effectiveness of this quantitative easing programme and identifies several key issues, including stock prices not rising in proportion to profits, the overvaluation of some small-cap stocks, and adverse impacts on corporate governance. It argues that before taking any steps toward monetary policy normalisation, the Bank of Japan should introduce flexibility in interpreting the 2% price stability target.

For years, the Bank of Japan (BOJ) has bought Japanese stocks as part of its massive monetary easing programme to lift the country out of deflation, and hit a 2% price stability target (Nangle and Yates 2017). Under Governor Haruhiko Kuroda’s Quantitative and Qualitative Monetary Easing package, stock-buying was begun as a monetary easing tool – in April 2013 at a pace of about ¥1 trillion annually, expanding to about ¥3 trillion in October 2014, and further to about ¥6 trillion in July 2016 (Shirai 2018a). The purpose was to increase aggregate demand and thus inflation, as well as to encourage Japanese savers to take on more risk by buying equities.

Unprecedented stock purchases as an monetary easing toolThe current exchange-traded fund (ETF) purchases are different from the past two practices conducted by the BOJ where banks’ stocks were purchased directly for financial system stability purposes – in 2002–2004, when Japan suffered a domestic banking crisis, and in 2009–2010, during and after the Global Crisis. The BOJ purchased stocks worth only about ¥2 trillion in 2002–2004 and about ¥400 billion in 2009–2010.

Some central banks do purchase foreign stocks and ETFs as part of their foreign reserve management strategies. Such purchases should be distinguished from the practices adopted by the BOJ, as the BOJ has focused on domestic stocks (stocks listed on the domestic stock markets). Central banks in emerging economies usually attempt to hold ample foreign reserve assets in preparation for volatile cross-border capital flows. In recent years, they have diversified their portfolio including risky assets to increase returns in the extremely low interest rate environment. Among advanced economies, the Swiss National Bank has intervened heavily in the foreign exchange markets since the Global Crisis, as the Swiss franc appreciated sharply due to its status as a safe haven currency. Given the limited amount of government bonds issued, the Swiss National Bank has found it necessary to intervene in the foreign exchange markets rather than conduct unconventional quantitative easing through government bond purchases.

Diversification of resultant accumulated foreign reserve assets is sought through purchasing various foreign assets including stocks. While the monetary policy meeting of a central bank determines the types and the amount of assets to be purchased to achieve its price stability mandate, foreign reserve management is generally conducted by professional external (private sector) reserve managers appointed by a central bank according to some strategic benchmarks set by the central bank.

There are very few central banks in the world that have purchased stocks on this scale and for such a long time as part of the conduct of monetary policy. So, when the BOJ embarked on its course of action, it had no reference to the experiences of other central banks. Similarly, the BOJ’s extremely challenging task of normalising the policy and ultimately disposing of the stocks purchased is without precedent.

The BOJ’s ETF purchases contributing to higher stock prices

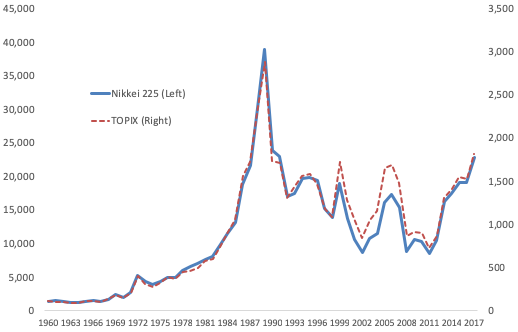

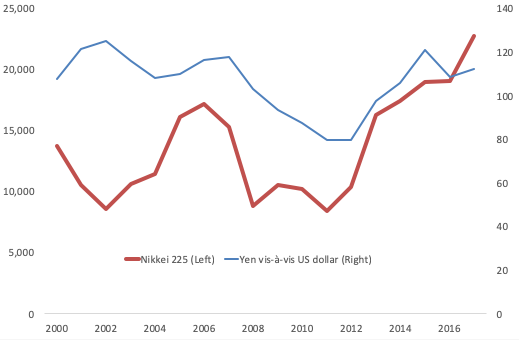

Stock prices began to rise from late-November 2012 in anticipation of the BOJ’s aggressive monetary easing – although they have never exceeded the peak recorded in late-December 1989 (Figure 1). Stock prices rose through various domestic and foreign channels. Domestic channels include the BOJ’s monetary easing (through a decline in short- and long-term interest rates, ETF purchases, and depreciation of the yen), as well as favourable corporate profits, which are also partially supported by the BOJ’s policy. Foreign channels include higher US stock prices and the appreciation of the US dollar against major currencies. There is generally a positive correlation between the exchange rate and stock prices as the yen’s depreciation contributes to higher yen values of foreign profits earned by Japanese multinational firms (Figure 2). Given that those multinational firms are listed on the stock market, the higher consolidated profits led to higher stock prices.

Figure 1 The Nikkei 225 stock market index (¥) and TOPIX index

Source: Bloomberg.

Figure 2 The yen vis-à-vis the US dollar and Nikkei 225 (¥)

Sources: Bloomberg; Bank of Japan.

We have dozens of posts on the BoJ, Swiss National Bank and others either planning or executing equity purchases.

Why has the price-earnings ratio declined?

Meanwhile, the BOJ’s heavy involvement in the stock market has invited much discussion in Japan, having given rise to the following five issues....MORE

Here's an example from Feb. 2008 (i.e. pre-LEH et al):

Doom and Gloom: What Can the Federal Reserve Do?

...I was reminded of a Financial Times story from March 25, 2002:

Fed Considered Emergency Measures To Save Economy

Minutes which summarized the meeting were released last week. A full transcript will not be available for five years but a senior Fed official who attended the meeting said the reference to "unconventional means" was "commonly understood by academics."

The official, who asked not to be named, would not elaborate but mentioned "buying US equities" as an example of such possible measures, and later said the Fed "could theoretically buy anything to pump money into the system" including "state and local debt, real estate and gold mines – any asset".......The question arises "Can the fed intervene in the Equities Markets?"

Again, two answers. 1) It's definitely something Central Bankers have thought about. 2) The Fed may need some enabling legislation which they would probably get if they requested it.

The FT reported February 21, 2002 "Japan Suspected of Stock Market Intervention".

A Google search finds 700 references to the "Stock Buying Body".

Here's a pungent one:

"We must halt this fall in shares. It's like diarrhea, we must stop it. The stock-buying body was set up precisely to absorb such selling (offloading of cross-shareholdings by banks). If February is such a month, there is no excuse for not functioning at that crucial time"

Here's another one, pungent in its own way, from 2013:Finance Minister Masajuro Shiokaw – Feb 7More relevant to the American markets are a couple Fed papers, the first of which is astounding for its frankness...MORE

"Central Banks Load Up on Equities as Low Rates Kill Yields"

First they buy up all the safe assets. Then they start buying into an already shrinking pool of stocks (Equities: The Wilshire 5000 is Down to 3687 Stocks) then...

I'm not sure I like where this is going.