From Alhambra Investment Partners:

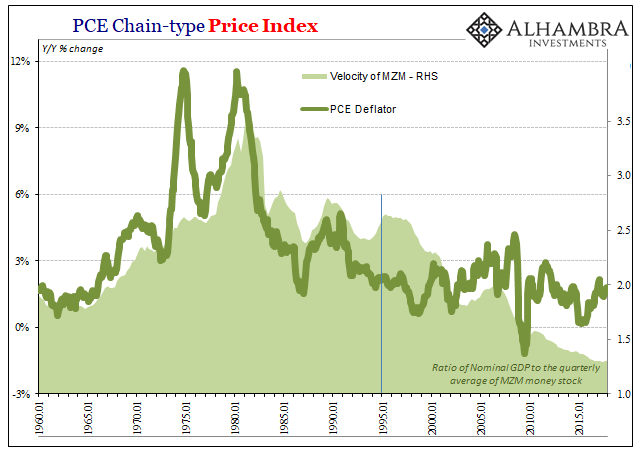

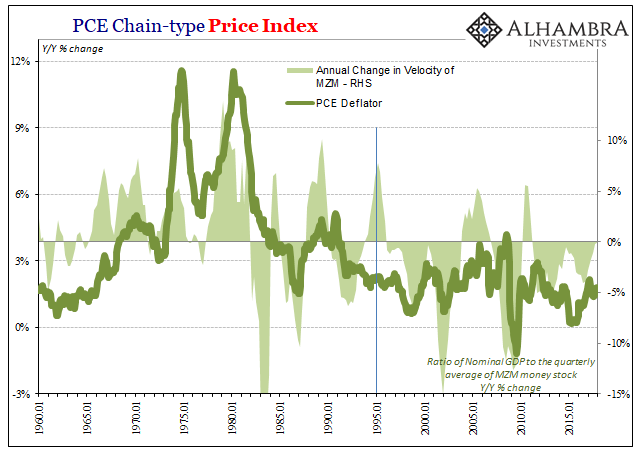

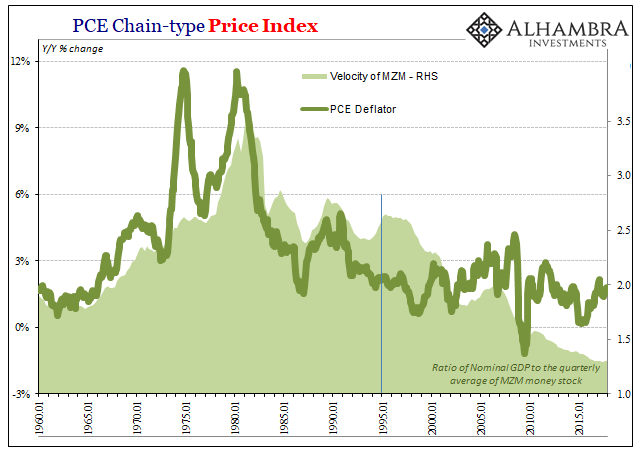

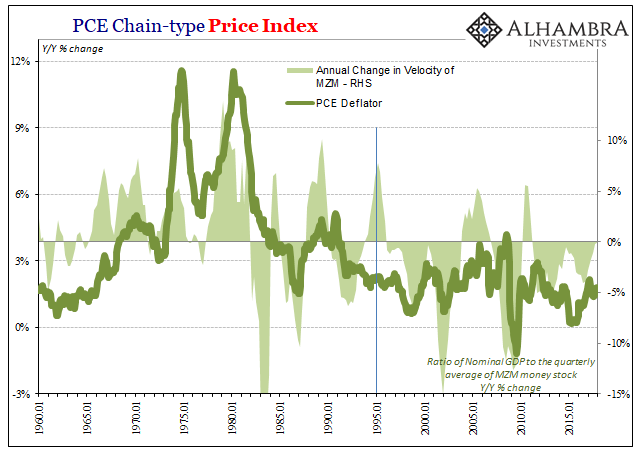

One less mainstream piece of this

inflation hysteria boom is the velocity of money. In case you haven’t

yet heard, monetary velocity is rising. From that we are supposed to

infer all the usual – wages, inflation, higher rates, and utter

destruction in bonds if not the whole Western economic structure.

The first part is technically true.

Money velocity increased in at least two primary stock indications.

Against both M2 and MZM, velocity has accelerated for two straight

quarters (through Q4 2017). The former has risen from 1.426 in Q2 2017

to all of 1.431 in Q4; the latter went from 1.295 to 1.299 in those same

six months.

Money velocity is, to put it mildly,

bunk. Changes in it are in most cases merely functions of accounting.

The equation of exchange presumes MV = PQ, and therefore (changes in) V

tells us something with regard to (changes in) P. Henry Hazlitt all the

way back in 1959 was having none of it:

I have said nothing above

about the much-discussed “velocity-of-circulation” of money, and its

supposed effect on prices. This is because I believe the term

“velocity-of-circulation” involves numerous irrelevancies and

confusions. Strictly speaking, money does not “circulate”; it is

exchanged against goods.

Since 2008 the changes in velocity are

explained entirely by either slight increases or decreases in nominal

GDP balanced against large increases (or now smaller decreases) in the

proportion of whatever stock measurement attributable to the leftovers

on the liability side of the Fed’s balance sheet (bank reserves)....MORE