CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

Following futures positions of non-commercials are as of February 13, 2018.

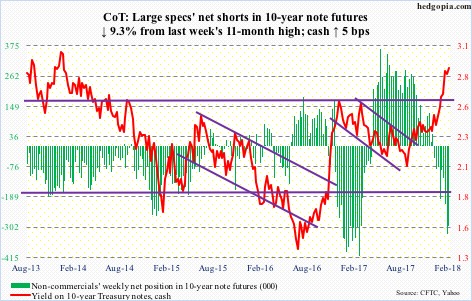

If 10-year Treasury yields (2.88 percent) reach three percent – or even where they are currently – would/could that be used as an opportunity to go long bonds? Possibly – at least near term. In fact, they did tag 2.93 percent Thursday before coming under slight pressure....MORE

Yields have come a long way in a short span of time. As early as September 7 last year, they were 2.03 percent. Not surprisingly, on nearly all timeframe, they have entered – or soon will – overbought territory. On the weekly chart, there have been back-to-back long-legged dojis.

The level to watch on the way down is 2.62 percent, which also represents the neckline of a reverse-head-and-shoulders pattern. Yields broke out of that resistance-turned-support a month ago. If it is a genuine breakout, in due course they could be headed toward 3.9 percent. Hence the significance of how bond vigilantes act around that level...