I'd have led with that sentence no matter who was the the President-elect, call me Pollyanna but it's true.

We've been gaming "What if" scenarios for the last ninety days and there are so many moving parts that it is difficult to keep track of them, even with zippy-fast 'puters which means: Opportunity.

If it were easy everyone would do it and there'd be no trade.

Money and politics are both manifestations of the same thing: power. It's been this way at least since the rise of agriculture and probably much longer.

And that is the reason the first inductee into the Climateer Hall of Fame was a politician. From our Feb. 2009 post "President Obama on Carbon, Climate and Energy":

...This stuff is all political and investors must keep an ear to the political ground or risk tremendous losses. There are only two viable approaches to rentseeking investing and politicians,

buy 'em or play 'em.

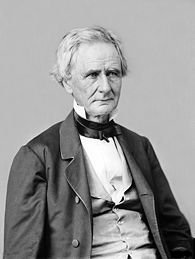

We must have the mindset of the first recipient of the prestigious Climateer Investing "Our Hero" award, the 26th Secretary of War and Democrat and Republican (!) Senator from Pennsylvania:

From our post on biofuels, March '07:

Finally for investors in rent-seeking organizations there is the real risk that the politicians will change the rules. Heed the words of Sen. Simon Cameron (R&D!-Pa.):

Our Hero

"The honest politician is one who when he is bought,

will stay bought."

will stay bought."

Staying on the self-referential (reverential?) train, here's a 2011 post with more back-links:

The End of Cheap Commodities (or not)

Back in 2007 we posted some articles on investing based on politics, using McCormick's reaper as an example....MORE

Although the reaper had been commercially available in 1840 sales didn't really get going until England repealed the Corn Laws. Here's a snip from "Global Warming, Politics, Laws and Opportunity":

...Invented in 1831 and patented in 1834, McCormick didn't sell a single machine until 1840. The sales figures for the early years are debatable but these are the best I could put together:This led to a look at the early years of The Economist, founded in September 1843 to advance repeal of the Corn Laws.

1840------- 2

1841--------0

1842--------7

1843------ 29

1844------ 50

1845------ 58

1846------ 75

1847-----800

External factors played a part: Florida, Texas and Iowa were admitted to the Union in '45, '45 and '46 respectively.

Miles of railroad trackage, 2818 miles in 1840 increased to 4633 in 1845 and 9021 in 1850.

The nation's asset base grew e.g. life insurance in force went from $4.7mm (face) in 1840 to $97.1mm in 1850. The country was growing pretty fast....

From "Global Warming, Politics, Laws and Opportunity--Part II":

To summarize part I (below) the McCormick family invented the reaper, sales in the first nine years were zero and in the next seven averaged 31 per year. They then exploded to 800 machines in 1847. What happened?The elimination of the tariff combined [so to speak -ed] with the mechanical harvester led to a huge increase in American grain exports to England and a dramatic lowering of unit costs, the two factors, greater volume and lower input costs began a 165 year decline in real food prices.

As reported by The Economist May 16, 1846, the British House of Commons had repealed the "Corn Laws", eliminating the tariff on imported wheat, the day before. Corn in this usage is not maize but rather is generic for grain. Prime Minister Peel won the battle but lost his premiership, the quote of the day was "Peel and repeal."...

The last post of the series, and the inspiration for today's headline was "The End of Cheap Food- What was Old is New Again AND: Profiting from Politics":

This story from The Economist got me thinkingHere's today's story from FT Alphaville:

(I know, alert the media).

Rising food prices are a threat to many;

they also present the world with an enormous opportunity

And what was I thinking about?FOR as long as most people can remember, food has been getting cheaper and farming has been in decline. In 1974-2005 food prices on world markets fell by three-quarters in real terms. Food today is so cheap that the West is battling gluttony even as it scrapes piles of half-eaten leftovers into the bin.That is why this year's price rise has been so extraordinary. Since the spring, wheat prices have doubled and almost every crop under the sun—maize, milk, oilseeds, you name it—is at or near a peak in nominal terms.The Economist's food-price index is higher today than at any time since it was created in 1845 (see chart). Even in real terms, prices have jumped by 75% since 2005. No doubt farmers will meet higher prices with investment and more production, but dearer food is likely to persist for years (see article). That is because “agflation” is underpinned by long-running changes in diet that accompany the growing wealth of emerging economies—the Chinese consumer who ate 20kg (44lb) of meat in 1985 will scoff over 50kg of the stuff this year. That in turn pushes up demand for grain: it takes 8kg of grain to produce one of beef....

Farm implements!

The Economist reported both ends of the story.

Not many publications can say that.

Grantham comes face-to-face with a paradigm shift...

Continuing that 2007 post:

Global Warming, Politics, Laws and Opportunity--Part II

...Two more recent examples of how changes in the law can lead to great opportunity were the "Taxpayer Relief Act of 1997" whose section 312 made the first half-million dollars of profit from the sale of a primary residence exempt from taxes and removed the requirement to reinvest the proceeds. Combined with the loose money policy of the Fed., the hot money/shenanigans at Fannie Mae and some pretty fancy footwork on the part of mortgage originators, this law set the stage for the residential real estate boom.

The other example is less well known. The 2003 Medicare Modernization Act established the Medicare Prescription Drug benefit as anyone with an older relative or friend knows.We'll be back with more.

The Bill also had a "Title II" regarding Medicare Advantage Plans. These plans had been around for years, since 1998 with declining enrollment.

The funding included in the MMA led to enrollment increases from 5.12mm members in 2004 to 7.18mm members in 2006, pretty fast growth for the insurance companies.

More spectacularly, one particular type of plan, "Private-Fee-For-Service" went from 26,932 members in 2004 to 819,352 members in 2006. Insurance companies don't get this type of growth unless they're getting the politicians to change the laws.

The companies that recognized what the changed laws (which I think they bought) meant to them made their investors a lot of money. The biggest promoter of the PFFS plans, Humana, saw its stock go from under $10 in April 2003 to $67 in October 2006.

That's why I'm going to be watching the politicians, and the people giving money to them.

In the meantime, here's a reminder that none of this is new. Things change, you play the cards you're dealt:

(click to enlarge)