SolarCity is currently trading at a discount to the implied merger price indicating some suspicion the deal won't close.

Tesla just raised $300 mil from Deutsche to fund their leasing program. They need to raise 20 times that amount to pull off what they are trying to accomplish.

See this morning's Bloomberg Gadfly "That SolarCity Spread Spells Trouble For Tesla" and CNBC's "Tesla shares to fall 21% on execution issues: Cowen".

Additionally yesterday's "Tesla’s Dream of Battery Domination Has Major Competition (TSLA)" shows how fast the state of play is changing in one part of Tesla's master plan for world domination.

From Musings on Markets:

Keystone Kop Valuations: Lazard, Evercore and the TSLA/SCTY Deal

It is get easy to get outraged by events around you, but I have learned, through hard experience, that writing when outraged is dangerous. After all, once you have climbed onto your high horse, it is easy to find fault with others and wallow in self-righteousness. It is for that reason that I have deliberately avoided taking issue with investment banking valuations of specific companies, much as I may disagree with the practices used in many of them. I understand that bankers make money on transactions and that their valuations are more sales tools than assessments of fair value and that asking them to pay attention to valuation first principles may be asking too much. Once in a while, though, I do come across a valuation so egregiously bad that I cannot restrain myself and reading through the prospectus filed by Tesla for their Solar City acquisition/merger was such an occasion. My first reaction as I read through the descriptions of how the bankers in this deal (Evercore for Tesla and Lazard for Solar City) valued the two companies was "You must be kidding me!".

The Tesla/Solar City DealIn June 2016, Tesla announced that it intended to acquire Solar City in a stock swap, a surprise to almost everyone involved, except for Elon Musk. By August 1, the specifics of the deal had been ironed out and the broad contours of the deal are captured in the picture below:

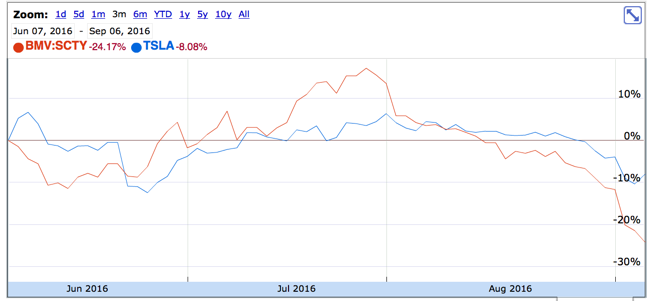

At the time of the deal, Mr. Musk contended that the deal made sense for stockholders in both companies, arguing that it was a "no-brainer" that would allow Tesla to expand its reach and become a clean energy company. While Mr. Musk has a history of big claims and perhaps the smarts and charisma to deliver on them, this deal attracted attention because of its optics. Mr. Musk was the lead stockholder in both companies and CEO of Tesla and his cousin, Lyndon Rive, was the CEO of Solar City. Even Mr. Musk's strongest supporters could not contest the notion that he was in effective control at both companies, creating, at the very least. the potential for conflicts of interests. Those questions have not gone away in the months since and the market concerns have been reflected in the trend lines in the stock prices of the two companies, with Solar City down about 24% and Tesla's stock price dropping about 8%.

The boards of director at at Tesla has recognized the potential for a legal backlash and as this New York Times article suggests, they have been careful to create at least the appearance of an open process, with Tesla's board hiring Evercore Partners, an investment bank, to review the deal and Solar City's board calling in Lazard as their deal assessor. Conspicuously missing is Goldman Sachs, the investment banker on Tesla's recent stock offering, but more about that later.

...MOREThe Banking Challenge in a Friendly MergerIn any friendly merger, the bankers on the two sides of the deal face, what at first sight, looks like an impossible challenge. The banker for the acquiring company has to convince the stockholders of the acquiring company that they are getting a good deal, i.e., that they are acquiring the target company at a price, which while higher that the prevailing market price, is lower than the fair value for the company. At the same time, the banker for the target company has to convince the stockholders of the target company that they too are getting a good deal, i.e., that they are being acquired is higher than their fair value. If you are a reasonably clever banking team, you discover very quickly that the only way you can straddle this divide is by bringing in what I call the two magic merger words, synergy and control. Synergy in particular is magical because it allows both sides to declare victory and control adds to the allure because it comes with the promise of unspecified changes that will be made at the target company and a 20% premium:...

Last week:

Tesla Motors: Nothing to See Here (TSLA; SCTY)

A Bad Day For Elon Musk and His Insurers (TSLA; SCTY)

"Elon Musk Faces Cash Squeeze at Tesla, SolarCity" (TSLA; SCTY)

Devonshire Research Group's Short Tesla Thesis, Part II (TSLA)