From Bloomberg Gadfly:

It has big ambitions to revolutionize finance. But those aren't matched by its funding or manpower. The blockchain industry is either hugely under-resourced or hugely over-optimistic. Probably both.

Despite a constant trickle of initiatives from the world's largest banks -- Deutsche Bank, Santander and UBS were the latest to tout a new settlement currency last month -- the numbers don't yet add up.

Pick up any one of the stacks of white papers on blockchain out there and you'll see bold and big forecasts about what the technology could mean for banks.

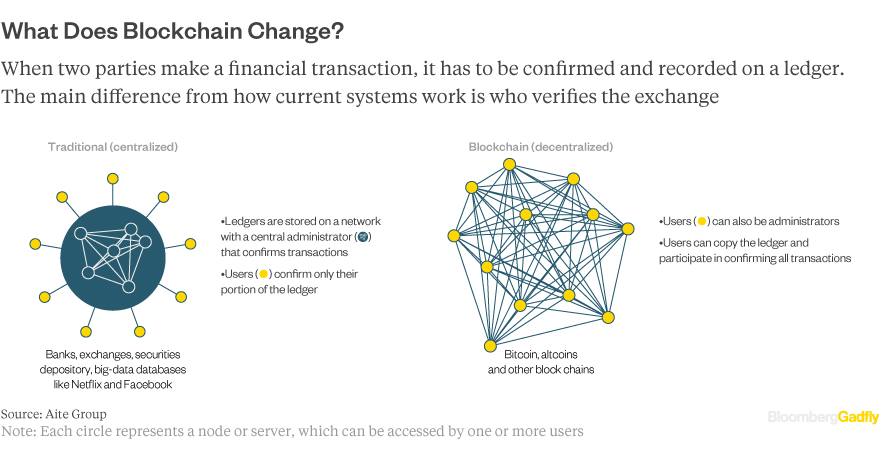

Existing IT systems for operating in capital markets cost between $100 billion and $150 billion a year, according to Oliver Wyman. Clearing and settlement fees are in the region of $100 billion. It's easy to see how a secure and decentralized transaction ledger, distributed and verified across a whole network of banks, could shave an easy 5 percent off these costs by 2022, as Oliver Wyman expects.

But what would banks need to spend to get to that level of cost reduction? In all likelihood, a lot more than what they're spending now.

Take one recent example of wholesale technological change: The very un-glamorous Target2 Securities pan-European settlement platform. (Next time, call it a blockchain, guys.)

It was designed in 2006 as a way to improve efficiency, cut costs and reduce complexity for settling cross-border trades in Europe. A decade and 2 billion euros later (divided between the ECB and the financial industry) it's still not fully rolled out. Official forecasts say the system will begin paying for itself in 2024 -- two years, remember, after blockchain will have supposedly also started to save the industry billions.

So a real-world example, then, that it takes 20 years for a new, efficient 2 billion-euro post-trade system with full central-bank backing to start recouping its cost. It would be a miracle if blockchain could repeat this feat in a fraction of the time without similar backing or funding.

To match such ambitious expectations would surely require some seriously large-scale resources -- which, despite the hype, bank-friendly blockchain technology has yet to attract....MORE