Electric Dragon

Albert Edwards has successfully predicted nine of the last zero collapses of civilisation.

Abandon all hope ye who enter this post

For Albert Edwards prowls within:

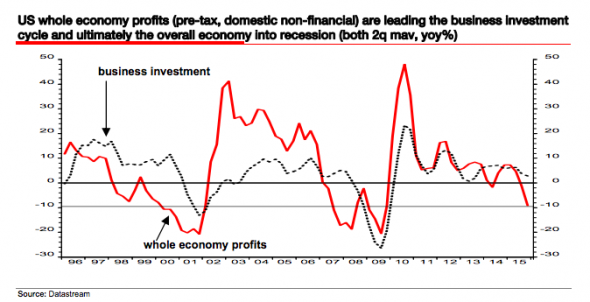

Despite risk assets enjoying a few weeks in the sun our failsafe recession indicator has stopped flashing amber and turned to red. Newly released US whole economy profits data show a gut wrenching slump. Whole economy profits never normally fall this deeply without a recession unfolding. And with the US corporate sector up to its eyes in debt, the one asset class to be avoided – even more so than the ridiculously overvalued equity market – is US corporate debt. The economy will surely be swept away by a tidal wave of corporate default.As he says, it’s the profits data that have sounded the economy’s death knell because while “Fed tightening may not be a necessary condition to catalyse a recession” the “deep profits downturn is sufficient in itself. Historically all recessions are effectively caused by slumps in business investment driven by a profits downturn.”

The converse is not true: business investment can decline, driven by a profits slump, and not necessarily generate an outright recession as was the case in 1985/86....MORE

Nov. 17

Société Générale's Albert Edwards Upbeat, Almost Chipper: See's Humanity Approaching Broad Sunlit Uplands (Nov. 17, 2010)

Oct. 20, 2010

Société Générale's Albert Edwards: Cry Havoc and Let Slip the...Ah Screw it (Oct. 20, 2010)

"Société Générale's Albert Edwards: 'Equity Investors Are In A Vulcan Death Grip And Are About To Fall Unconscious"' (September 2010)

Société Générale's Albert Edwards: "I Have Been Wrong – I’ve Been Too Bullish" (Jan. 17, 2011)

Société Générale's Albert Edwards: "Many Think I am Mad..." (sub 2% Treasuries, S&P at 400 etc.) May 25, 2011

On September 5, 2008 we posted "Meltdown"-Société Générale" which linked to Albert's research note of a couple days earlier:

On September 7, 2008 Fannie Mae and Freddie Mac were placed into conservatorship.

On September 14, 2008 Merrill Lynch agreed to be acquired by Bank of America to avoid a net cap shutdown.

On September 15 Lehman filed their bankruptcy petition.

On September 16 AIG became a 79.9% subsidiary of the U.S. Treasury.

Within 10 more days the Nation's largest thrift, WaMu was seized and five days later Wachovia was gobbled up.

Albert is better at credit markets than he is at equities and like many bears, Gluskin Sheff's David Rosenberg being a prime example, Albert doesn't put enough weight on the efforts of the Central Banks to change reality more to their liking.

Whether in the long run those efforts succeed or not, they should inform ones wagers in the present.