From FT Alphaville:

What is a hard landing? Can you re-land hard if you’ve already landed hard? What about just landing harder? Or what about a long hard landing?

The phrasing here is getting awkward, as is the real point, which is the concern that the hardest Chinese landing is yet to come.

You can see why it’s on people’s minds: Chinese reforms have been less than impressive, there’s a general consensus that its record breaking debt load is bad (for a given definition of bad that normally doesn’t include an immediate crisis), and credit growth is still heading up. Take this from Bernstein’s metals and mining team on Monday for example:

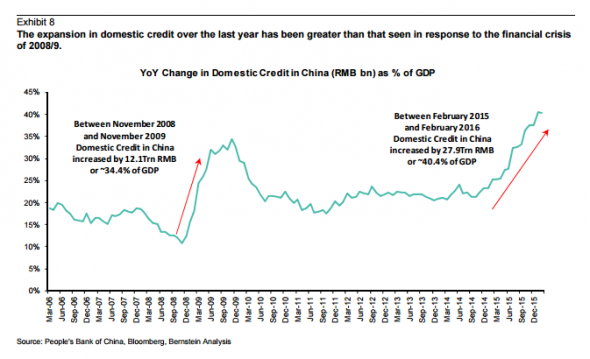

The response to the crisis of 2014/2015 appears to be greater than the response to the financial crisis of 2008/9. Between November 2008 and November 2009 total domestic credit expanded from 36.3Trn RMB to 48.4Trn RMB, a change of 12.1Trn or ~34.4% of 2009 GDP. Between February 2015 and February 2016 domestic credit has grown from 111.2Trn RMB to 139.2Trn, a swing of 27.9Trn, or ~40.4% of GDP.

The evidence for this can also be found in the money supply growth figures and the growth in the assets and liabilities on the balance sheets of Chinese banks. M2 money supply growth has recovered from trough levels witnessed in mid-2015. However, it is M1 money supply growth – the measure of the more liquid component of the money supply – that has really taken off. Meanwhile, we have seen a surge in the growth of Chinese domestic banks’ assets and liabilities since the start of 2015.

Again, that seems pretty bad.

Which leaves us to ask, where hard landings are concerned: how would you describe what we’ve already experienced?

Speaking of, you may remember this:

And, even if you don’t, here’s SocGen’s opening few pars:

Our core scenario is that China will grow by 7.4% in 2013. There is still a chance however that China could land hard, with growth of less than 6%.

A survey of global investors suggests that most underestimate how much asset prices would fall if China does land hard.

We believe base metals could drop 50%, while the USD rallies and treasuries outperform other debt markets and global equity markets.

We thought some compare and contrast might be in order.

To be clear, this isn’t meant as a shot at SocGen. Frankly, they did a pretty good job mapping this stuff out and were admirably sceptical about China’s growth path. And they got the primary issue right, that it’s “the top leaders’ choices during the difficult times ahead that will determine the fate of the Chinese economy.”...

...MUCH MORE

*Every few years it seems there is a new entrant in the "Harder than diamond" stakes.

The perennial contender was rhenium diboride but that was only on one dimension of hardness.

The most recent discovery is a new phase of carbon titled Q-carbon because it is superheated and then quenched.

It goes to 11 on Mohs hardness scale.

(technically >10, the 11 bit was just a cheap Spın̈al Tap ref)