From Bloomberg:

The profit margins debate could lead to an unsettling conclusion.

One of the most heated debates among investors is the question of whether corporate profit margins can maintain their elevated level, or whether they will inevitably mean revert.

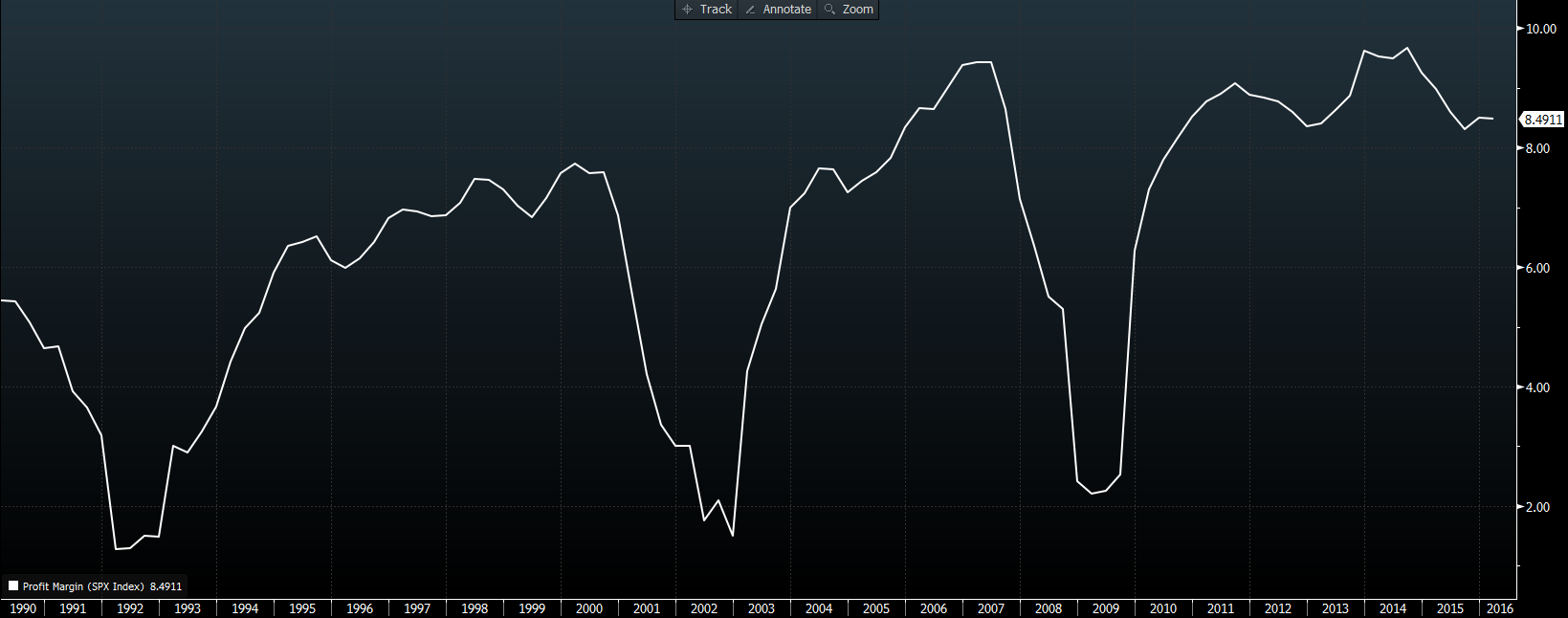

Here's a quick look at S&P 500 profit margins, for example, going back over 25 years. They remain high by by historical standards.

A new note from Goldman Sachs Group Inc. analysts led by Sumana Manohar looks at the bull and bear arguments for the profit margins debate.

Manohar argues that profit margins have expanded thanks to four key trends: strong commodities prices, emerging market cost arbitrage (companies making things more cheaply in emerging markets), demand growth from emerging markets, and improved corporate efficiency driven by the use of new technology. Continuing one of its major analytical themes of recent months, Goldman also notes that the market has rewarded companies that have undertaken mergers and share buybacks, compared to companies that have invested internally, further bolstering margins.

So will profit margins inevitably roll over?

Goldman goes through both sides of the argument. On the bull side, the bank says that ongoing consolidation in industries, cost deflation, and tighter purse strings help keep a floor under margins. Ultimately though, it thinks that the above trends, coupled with weak demand and general industrial overcapacity, mean that margins are likely to come down.

But what if margins stay elevated? That too is possible, and the implications could be unsettling.

Goldman writes: "We are always wary of guiding for mean reversion. But, if we are wrong and high margins manage to endure for the next few years (particularly when global demand growth is below trend), there are broader questions to be asked about the efficacy of capitalism."......MORE

We take this stuff seriously. In April 2011 we awarded the prestigious Climateer Line of the Day to Mr. Grantham for:

“Profit margins

are probably the most mean-reverting series in finance, and if profit

margins do not mean-revert, then something has gone badly wrong with

capitalism. If high profits do not attract competition, there is

something wrong with the system and it is not functioning properly.”

– Jeremy Grantham

I'm sure he treasures the memory of the spring day that he won the CLoD.

See also:

November 2011

Jeremy Grantham on Corporate Profits and Mean Reversion

September 2012

The Paradox of Profit Margins and Another Look at the Theory of Everything

July 2013

What If There's No Mean Reversion? (Grantham Mayo Van Otterloo quarterly letter July 2013)

December 2013

Andrew Smithers on Labor, Capital and Taxes

August 2014

Corporate Profitability and Labor

November 2014

Why Jeremy Grantham is Right About Corporate Profit Margins

September 2015

Harvard Business Review: The End Of the High Profit-Margin World

It's about time.

We (okay, Jeremy Grantham and we) have been banging on since 2011 about how, in theory anyway, profit margins should be the most mean-reverting series in finance, at least if capitalism is working as it is supposed to, and that the failure to mean-revert is a sign of something being deeply wrong with either the theory or the reality.