Back in February 2008, i.e. seven months pre-

- September 7, 2008 when Fannie Mae and Freddie Mac were placed into conservatorship.

- September 14, 2008 when Merrill Lynch agreed to be acquired by Bank of America.

- September 15, 2008 when Lehman filed their bankruptcy petition.

- September 16, 2008 when AIG became a 79.9% subsidiary of the U.S. Treasury.

- And the next 10 days when the Nation's largest thrift, WaMu was seized and five days later Wachovia was gobbled up and we were off to the races.

As I said, abiding.

From FT Alphaville:

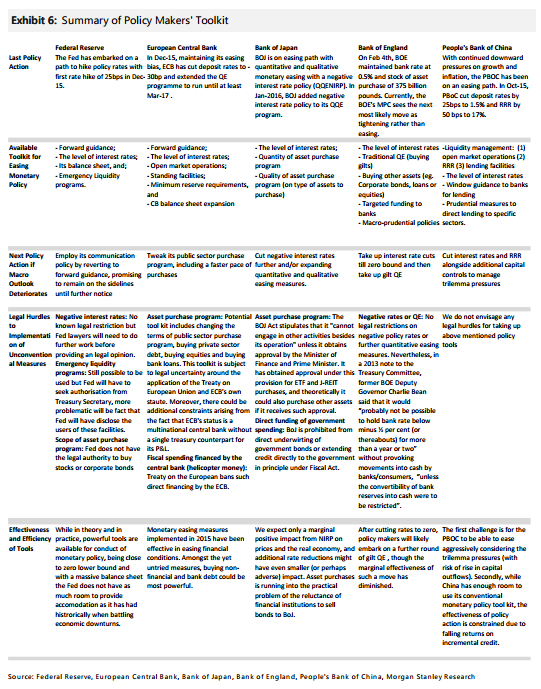

Central bank ammo, cut out and keep edition

By Morgan Stanley, do obviously click to enlarge:

Will that do anything to assuage fears that central banks are running out of juice? The suggestion was that some of that fear manifested earlier this month because the Bank of Japan decided to go negative. As Barclays said before, “the BoJ’s move to more negative rates appears to have been one of the triggers of a broad-based deterioration in global bank stocks.” Or:Somewhere down the road I'm pretty sure I'll be referring back to this post and get to use the:

… markets are increasingly concerned that the BoJ specifically, and central banks in general, are at the limits of their arsenals’ range. The turn towards negative rates implicitly signalled that the limits of balance sheet expansion as a policy tool are near, and conventional wisdom is that negative nominal rates are bounded by concerns over bank profitability.MS put that a bit more fully too, with our emphasis:

As more central banks around the world adopt a negative interest rate policy, increasing concerns have been voiced as to the potential negative implications of keeping interest rates low for an extended period of time and the side effects of implementing a negative interest rate policy. The concerns are usually three-fold: (a) low or negative interest rates could lead to financial instability, (b) unproductive sectors could be kept operating with low rates, with adverse implications on productivity growth, (c) aggressive monetary easing reduces the impetus for fiscal policy and/or reforms.Does the ability of central banks to do more in the neg rate direction, assuming legal hurdles can be overcome, represent a good or an ill then?...MUCH MORE

"Out of ammo, throwing rocks"formulation.