FT Alphaville does, and it's Alloway's counterparty from one of the more disturbing oil trades of recent years who wrote it up:

Petrodollars as the new vendor-financing feedback loop of hell

FT Alphaville readers will not be strangers to the argument a ballooning petrodollar float over the last decade set alight an emerging market export feedback loop, one of dot comedy vendor-financing proportions. Or how encumbered petrodollars have played an important role in the counterintuitive side-effects of a drop in the price of oil.

The analysts at Citi are on the case as well, calling it “Oilmageddon — death by circular reference”.

Here’s the thrust of their argument set out in a note published Friday (our emphasis):

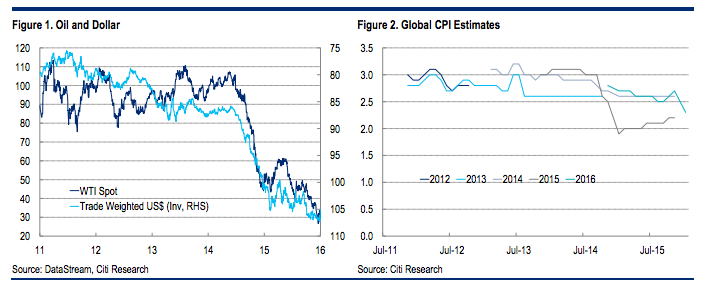

It appears that four inter-linked phenomena are driving a negative feedback loop in the global economy and across financial markets: 1) stronger USD, 2) weaker oil/commodity prices, 3) weaker world trade/capital flows, eg petrodollars, and 4) weaker EM growth. This cycle then repeats.

It seems reasonable to assume that another year of extreme moves in USD (higher) and oil/commodity prices (lower) would likely continue to drive this negative feedback loop and make it very difficult for policy makers in EM and DM to fight disinflationary forces and intercept downside risks.Corporate profits and equity markets would also likely suffer further downside risk in this scenario of Oilmageddon. Equity markets have suffered a bear market correction in the last few months, oiled by this negative feedback look and a simultaneous crisis of confidence in policy makers around the world.Meaning it’s petrodollars which have been behind the most spectacular moves in financial markets in the last 1-2 years:

According to Citi’s head of EM economics, David Lubin, this highlights the relationship between commodity prices, global trade and the role of petrodollars across EM economies — prompting the question of how on earth we forgot about these relationships in the first place? But anyway… here are Lubin’s thoughts on how the loop is playing out:...MORETangentially related:

Iranian Oil: Europe to Import At Least 300,000 Barrels/Day; Iran Says "No Petrodollars, Please"

And yes, in the above story we did read the 'using the dollar exchange rate as a reference' bit. The point is, what currency are the Indian, Chinese, European etc. trades settling in?