In the instant case Goldman is guilty so David Keohane unpacks stuff for us.

From FT Alphaville:

Goldman does New Wave

Pick your terrible band-gag: Simple Minds… Tears for Fears… Rough Trade… Er, Alphaville.

From Goldman, our emphasis:

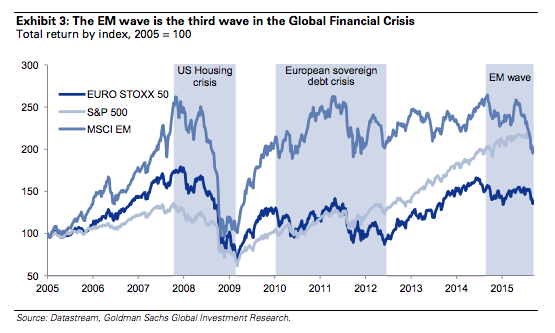

The financial crisis can be viewed as a number of separate but related waves. Wave 1; the US Wave started with the housing market collapse, spread into a broader credit crunch and ended with the Lehman collapse and the start of TARP and QE. Wave 2; the European Wave began with the exposure of banks to leveraged losses in the US and spread into a sovereign crisis, given the lack of a debt sharing mechanism across the Euro area. It ended with the OMT, promises to ‘do whatever it takes’, and finally the introduction of QE. Wave 3; the EM Wave coincided with the collapse in commodity prices.

This revolving crisis, coming in three waves, has disrupted the typical path of equity market recovery. In most historical cycles we can identify four distinct phases in the equity market, which we describe as ‘Despair’, ‘Hope’, ‘Growth’, and ‘Optimism. While all markets entered a classic ‘Despair’ phase around the US stage of the crisis and the global economic downturn of 2009, and then began a strong ‘Optimism’ phase in response to US QE, the recovery phase was knocked off track in Europe by the emergence of the bank and sovereign crisis. EM markets were moving into Optimism, supported by very accommodative US policy and credit growth. But as Europe finally entered a ‘Growth’ phase in 2012, bolstered by aggressive policy easing, EMs were just entering their next ‘Despair’ phase.

With increased focus on EMs, and concerns about their impact on global growth, investors are at a crossroads, with each path potentially leading to quite different outcomes for markets. Either we are facing the ‘secular stagnation’ that many investors fear, and that bond markets (and increasingly credit) seem to be implying, or, the slowdown in EMs can be viewed as the final stage of the financial crisis. This stage, like the US and European stages that preceded it, is forcing balance sheet adjustments and rebalancing economies in a necessary way to build the foundations for a gradual ‘normalisation’ of activity, profit growth and interest rates.

Of course, each wave feeds upon the ones that came before and it would be difficult to view the China-led EM wave in isolation, ignoring the spur the downturn in the west gave to Chinese stimulus from 2007 and the fact that low interest rates in the west helped drive Chinese leverage. As Citi said a few weeks back: ““China contributed $3.5tr or almost half of the global banking sector loan increase of $7.6tr since 2009, while major EMs together contributed for c75% of global loan increase between 2009 and 2014.” ”

Or if you want the even more wide-angled GS chronology:

1. 1997 Asia financial crisis hits global growth expectations and sends deflationary pressures into the world economy. Interest rates are cut and EMs respond by building domestic savings....MORE

2. Following a period of very low inflation and interest rates, economic growth improves; DM equities rise in value, US credit growth increases.

3. The equity bull market turns into a bubble, driven by a boom in technology stocks (fueled by cheap money and low bond yields) and rising optimism about globalisation and future productivity growth....