Oil: "Is the US Refining Party Over?" (VLO; TSO; HFC; MPC; WNR)

From RBN energy Aug. 16:

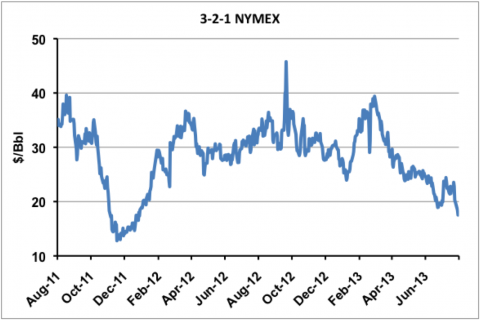

Last week (August 7, 2013) the 3-2-1 crack spread based on NYMEX CME

crude and refined product prices that is seen as a proxy for the

performance of US refinery margins, reached a two year low. The 3-2-1

crack has fallen 56 percent this year from its high in March. At the

same time refineries are still processing crude like there’s no tomorrow

– at over 90 percent of capacity. Can the party continue? Today we peak

through the cracks to uncover what’s going on.

What is a 3-2-1 Crack Spread?

To explain - the term “crack” does not refer to something a wayward

crude trader might ingest in the bathroom but rather to breaking down or

“cracking” crude oil. The term “spread” means the difference between

the sales price of the refined products and the raw material cost of

crude i.e. the refining margin. The 3-2-1 Crack spread approximates a

refinery that produces two barrels of gasoline and one barrel of diesel

for every three barrels of crude input. In other words the refinery

yield is two-thirds gasoline, one-third diesel (see Bakken Buck Starts Here Part IV).

In our case the 3-2-1 crack we are looking at is the NYMEX CME

futures market proxy for a refinery margin that is calculated using

nearby delivery contract prices for New York Harbor gasoline and diesel

(aka heating oil) and subtracting the cost of West Texas Intermediate

(WTI) crude. This is the most widely followed crack spread because it

roughly approximates the state of the US refining business. RBN Energy

keeps a running tally on the 3-2-1 crack - you can see that chart and

those of other important market indicators on our website. You get

access to more detail behind the charts if you are an RBN member (see About Spot check Indicators).

Falling Through The Cracks

The chart below shows the 3-2-1 crack spread over the past two years.

At the start of that period in August 2011, the WTI price was about a

year into its three-year period of heavy discount to the international

benchmark Brent crude (for chapter and verse on that saga see Strangers in the Night).

Because inland crude prices like WTI were low, and the price of refined

products in New York on the East Coast were based on higher

international crude costs, the 3-2-1 crack in August 2011 was hovering

around a very healthy $40/Bbl. Then the WTI discount to Brent narrowed

sharply in the fall of 2011 as the market believed that the first phase

of the Seaway pipeline reversal would miraculously solve the Midwest

crude logjam quickly and that inland crude prices could return to

coastal levels. That turned out not to be true once Seaway Phase 1

opened up in January 2012 and had little impact on the huge crude

stockpile in Cushing, OK. The WTI discount to Brent widened out again in

2012 and 3-2-1 crack values bounced back over $30/Bbl. And they stayed

at those levels until this year. The 3-2-1 crack peaked at $39.40 on

March 8, 2013 and ever since then has been on a downward trend –

reaching a low of $17.50/Bbl on August 7, 2013.

Why has the 3-2-1 crack spread fallen by 56

percent since March 2013? The chart below shows the components of the

spread in $/Bbl this year. The prices of diesel and gasoline (red and

blue lines respectively on the chart), the refined products in the crack

spread, basically tracked WTI crude prices (green line) through March.

During March and April product prices were higher when output from Gulf

Coast refineries that normally help meet demand on the East Coast was

reduced by refinery maintenance (see Turn Around).

That led to the near $40/Bbl 3-2-1 crack in early March. Ever since

then the crack spread has tanked and the chief culprit was a rapid

increase in WTI prices (brown dotted line on the chart). WTI prices

increased by nearly $20/Bbl between April and June and product prices

were flat over the same period. During this same period as WTI prices

increased, refiners increased their crude throughput rapidly – chasing

the higher margins....MORE