There's a little black spot on the sun today...

Back in January we posted "

Bain Capital's Investments: 1984-1999":

DB Alex. Brown via the Los Angeles Times:

This private prospectus was developed by Deutsche Banc Alex. Brown in

2000 for those who could invest a $1-million minimum in Bain Capital

funds. It includes the investment history of Bain Capital from 1984

through 1999, most of the years that Romney ran the firm. After

obtaining the prospectus, the Los Angeles Times asked Stanford

University economics lecturer Alex Gould to review and interpret the

document. Gould is a research fellow at the Stanford Institute for

Economic Policy Research and has experience in the world of private

equity and venture capital investing. The prospectus, annotated with his

comments, appears below...MORE

HT:

The New Yorker who writes:

...The prospectus listed sixty-eight companies that Bain Capital’s

private-equity funds invested in between 1984 and 1998. It said the

funds made an annual return of eighty-eight per cent, which means they

almost doubled their money every year. On “realized

investments’’—companies that Bain Capital had sold or taken public in an

I.P.O.—the investment funds did even better. Over this fifteen-year

period, according to the prospectus, the realized investments generated

an astonishing annual return of a hundred and seventy-three per cent....

A couple days ago Barry Ritholtz posted "

No Alpha: Bain Capital’s Investment Results" at The Big Picture:

The political season is in full throat. While everyone is focusing on

Mitt Romney’s VEEP selection of Paul Ryan, perhaps it is time to

refocus our views elsewhere.

During the primaries, there were all manner of attacks on Bain

Capital as a proxy for Mitt Romney. The criticism for outsourcing and

layoffs, for the fortune he earned (estimated at $190 – $250 million).

Bain saddled some companies with huge debt, using the proceeds to

extract large fees. It was a very sharp elbowed form of capitalism.

Surprisingly, the criticism came not from the left, but from Romney’s

primary challengers on his right. Strange.

This morning, we are going to review how Bain Capital actually

performed as investors. No, they did not (as claimed) return 113% per

year. In fact, their investment performance, according to their own

data, was rather unremarkable.

Ignore the anecdotal attacks from both opponents and supporters.

Thanks to two intrepid Wall Street Journal reporters, the full

Romney/Bain record has been reviewed. During the GOP primaries, Mark

Maremont of the Journal completed a comprehensive assessment of Bain

Capital, including all “77 businesses Bain invested in while Mr. Romney

led the firm from its 1984 start until early 1999.” And on August

5, Brett Arends released the ebook

The Romney Files, which includes extensive reviews of Bain Capital.

• $1.1 billion invested generated $2.4 billion in gains for its investors over 16 years;

• 22% of the companies either filed for bankruptcy reorganization or closed their doors;

• An additional 8% ran into so much trouble that Bain lost 100% of client money invested in each deal;

• Bain’s returns came from just a small number of investments. Ten deals

produced more than 70% of the total dollar gains. (4 of the 10 of these

businesses later ended up in bankruptcy court).

• Several of Bain’s biggest successes became household names: Staples, Domino’s Pizza Inc. and Sports Authority.

The Journal analysis shows that in total, Bain produced about $2.4

billion in gains for its investors in the 77 deals, on about $1.1

billion invested. This is before fees, which typically run in the range

of 2% annually plus 20% of profits (widely known as “2+20”); Some newer

Bain funds run 1 & 30, while some older funds ran 1.5 + 20.

That sounds like a great deal – but it is a far less attractive when you do the math and compare to other alternatives.

The Journal sourced its analysis from a list of 77 Bain investments

covering 1984 through 1998 that were included in a document Deutsche

Bank AG used to raise capital for a new Bain fund in 2000. The Deutsche

Bank doc cites Bain as a source; these deals accounted for about 90% of

the money Bain invested during that period. (The Journal days it

obtained “updated information from a similar 2004 prospectus.”)...MORE

You may also be interested in:

"Fun Fact: Mitt Romney Was Also A Hedge Fund Manager "

Barack H. Obama The Trader-in-Chief

No , not a Rezko story

"Unions Hate Private Equity, but They Love Its Profits"

"What Debt Did for Romney"

George Washington Would Beat Out Romney as Richest President; John Kerry Would Have, Too

Forbes: "What Mitt Romney Is Really Worth: An Exclusive Analysis Of His Latest Finances"

"Romney’s Top 10 Wealth Gaffes"

King of Bain': 6 questions answered about anti-Mitt Romney attack ads

M&A "That’s One Reason to Delay a Deal"

Bain Capital has delayed its $3.7 billion takeover of Skylark, a

Japanese restaurant chain, following a late-August outbreak of dysentery

that shuttered 120 locations for about a month, according to the

publication Basis Point. Read more »

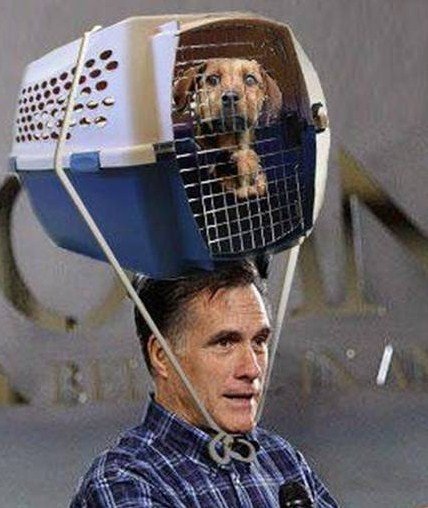

It's a Dogfight: 11 Best Tweets on the President's Dog-eating Childhood

"I don't care who ya are, now that's funny!"

-Mitt