Could-be U.S. President Willard Mitt Romney has played many roles in his life: Governor. Husband. Hairdresser. People-firer. Hoagie-lover.Previously:

But did you know that he has also been a hedge-fund manager?

We didn't either, until Fortune's Dan Primack did some splainin' this morning in his "Term Sheet" email newsletter. It seems Romney, in yet another one of his many roles, this time as Imperial High Potentate of the private equity firm Bain Capital, was hanging around the shop one day in 1996 when he and the Bain boys decided to engage in some of their typical hijinks. Just for a crazy mix-em-up, one of them said, why don't we go to the "stock market" and buy us some "stocks," as the rabble call them.

And so that's what those pranksters did. They bought some stocks and became a gosh darn hedge fund. They raised some money, named it Brookside Capital, slapped it on the rump and started buyin' stuff. They figured they could make a ton of money using their private-equity know-how in the public markets, because of synergies or Six Sigma or something.

All anybody knows is that it worked -- maybe because Mitt Romney knows business, that's why. The thing is still around and hasn't caused any black holes in anybody's money that we know of, though it did lose 17 percent before fees during the crisis, according to Bloomberg, which almost makes it sound like not much "hedging" was going on at old Brookside....MORE

Bain Capital's Investments: 1984-1999

Barack H. Obama The Trader-in-Chief

No , not a Rezko story

"Unions Hate Private Equity, but They Love Its Profits"

"What Debt Did for Romney"

George Washington Would Beat Out Romney as Richest President; John Kerry Would Have, Too

Forbes: "What Mitt Romney Is Really Worth: An Exclusive Analysis Of His Latest Finances"

"Romney’s Top 10 Wealth Gaffes"

King of Bain': 6 questions answered about anti-Mitt Romney attack ads

M&A "That’s One Reason to Delay a Deal"

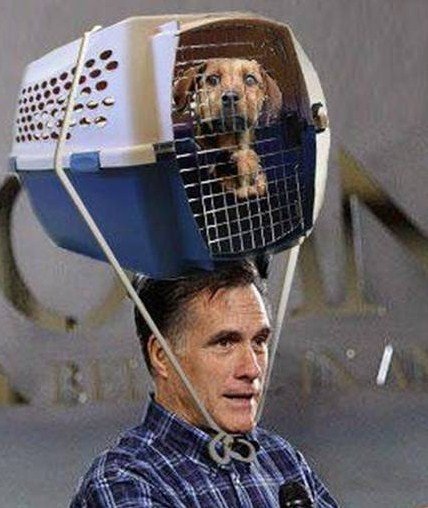

Bain Capital has delayed its $3.7 billion takeover of Skylark, a Japanese restaurant chain, following a late-August outbreak of dysentery that shuttered 120 locations for about a month, according to the publication Basis Point. Read more »It's a Dogfight: 11 Best Tweets on the President's Dog-eating Childhood

"I don't care who ya are, now that's funny!"

-Mitt

-Mitt