September 5, 2008

Green on the Screen: Solars

It is not a market for "Til Death Do Us Part" but the solar group is bouncing off today's bottoms.If gentle reader will indulge another dip into the archives:

The first four trading days of September have been brutal. At today's lows we've seen declines of:

FSLR... 20.8%%

YGE..... 20.6%

TSL...... 20.1%

STP...... 19.4%

LDK..... 18.6%

SPWR...17.5%

ENER ...17.0%

Basically a bear market in 3 1/2 trading days.

So we can look for a bounce but think of these names as a trade; bear markets can suck you in. When I first came to the market, one of the older traders told me he was saved in the '73-'74 bear by a cartoon:

(click to enlarge)

That's Alfred Frueh's January 16, 1932 New Yorker classic, "Just around the Corner", commenting on President Hoover's statement that "Prosperity is just around the corner".

Bull Markets; Bear Markets; Secular and Observant

This is a repost/mashup of a couple points that bear [good one -ed] repeating. No bull [lame-o -ed]

...Secular bear markets are characterized first by the initial decline and then by P/E multiple contraction.

During the last secular bear, 1966-1982, the cyclical bear of '73-'74 had a S&P 500 trailing four quarters P/E of 6.97 for the quarter ending 9/30/74 while the '80-'82 cyclical had a P/E low of 6.68 for the quarter ended 3/31/80. One of my favorite Warren Buffett quotes:

December 31, 1964: DJIA 874.12

December 31, 1981: DJIA 875.00

The Big Picture had a Morgan Stanley chart we lifted in August '09:“Now I’m known as a long-term investor and a patient guy, but that is not my idea of a big move.”That’s a secular bear market.

-Warren Buffett

>

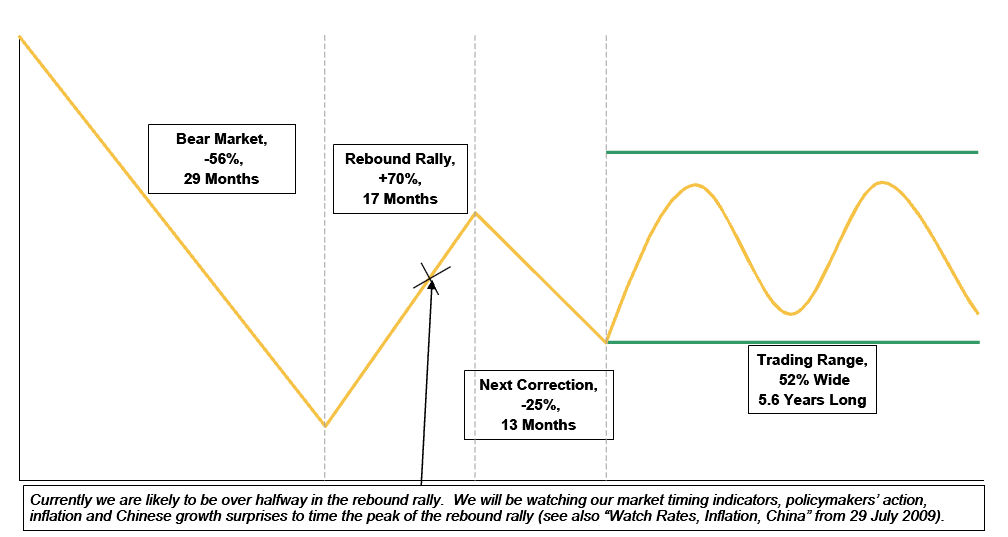

The Chart represents typical secular bear markets based on MS’s sample of 19 such bear markets as shown after the jump....

Here are a couple more charts showing other aspects of the phenomena

Where in the Bear are We?

Dow Chart with P/E, 105 Years

click for larger chartOne etymology of the word speculation:

Source: Crestmont Research

c.1374, "contemplation, consideration," from O.Fr. speculation, from L.L. speculationem (nom. speculatio) "contemplation, observation," from L. speculatus, pp. of speculari "observe," from specere "to look at, view" (see scope (1)). Disparaging sense of "mere conjecture" is recorded from 1575. Meaning "buying and selling in search of profit from rise and fall of market value" is recorded from 1774; short form spec is attested from 1794. Speculator in the financial sense is first recorded 1778. Speculate is a 1599 back-formation.That is not the etymology grandmother taught me. Hers had to do with Italian merchants keeping watchtowers manned to spot sails over the horizon, enabling those who could see furthest to sell off inventory before goods-ladened ships made harbor and crashed the market. More like this etymology at Wictionary:

From Latin speculātus, past participle of speculor (“‘look out’”), from specula (“‘watchtower’”), from specio (“‘look at’”)Either way, the current market does not lend itself to either contemplation or seeing over the horizon....

**From Investing the Middle Way (2006)Death of the American Dream? (nah)

Source: Profutures, click to enlarge

Markets: Is This Bull Cyclical or Secular?

Best strategy for long bear market 2010-2020

Gail Dudack on What's Ahead for the Stock Market

Stock markets – secondary or primary bull?

and here's ELO: