Want Clean-Energy Investment? Offer More TLC, Deutsche Bank Says

Dealing with climate change is undoubtedly becoming big business. But that big business depends on governments—the push to curb greenhouse-gas emissions or boost clean energy is inextricable from government targets and mandates.

For Deutsche Bank, this means that what governments do on the climate and energy front will be increasingly important for investors around the world, even if that hasn’t always been the case so far.

In a nutshell, Deutsche Bank Climate Change Advisors conclude in a big new report out today, investors want TLC—“transparency, longevity, and certainty”–in government energy policies. Countries that offer that—Australia, Brazil, China, France, Germany, and Japan—will attact capital. Countries that don’t—including the U.S. and the U.K.—will struggle.

“Investors will become increasingly concerned about regulatory risk and thus countries that deploy a transparent, long-lived, comprehensive and consistent set of policies will attract global capital,” writes the investment bank. “Many major emitters such as the US do not have enough ‘TLC’ in their policy frameworks.”>>>MORE

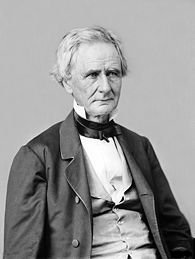

To put it a bit more bluntly, Sen. Simon Cameron, D. and R. PA:

...Finally for investors in rent-seeking organizations there is the real risk that the politicians will change the rules. Heed the words of Sen. Simon Cameron (R&D!-Pa.):

"The honest politician is one who when he is bought, will stay bought."

Our Hero