Solar panel makers face dark times; the best that can be said is that a collapse in pricing at least brings solar technology costs down to where they become competitive without heavy subsidies.Industry survivors will be those that vertically integrate, or in many Western firms' cases, accelerate outsourcing and concentrate on branding and client relationships - but even that will require a decent balance sheet.

The wild-card remains that large integrated tech firms with more robust finances step in to collect the wounded once the bloodbath ends.

Malaise

A supply glut from low-cost Asian players that is destroying margins and balance sheets is the root of the malaise.

This dismal state of affairs jars with solar's impressive volume growth. Globally, from 2002-2008 compound annual growth for panel shipments ran around 50% and would probably have been higher were it not for polysilicon supply bottlenecks, the raw material used to make solar cells.

That supply constraint triggered an aggressive capacity ramp-up across the production chain resulting in the pendulum swinging from apparently chronic undersupply to now rampant oversupply.

In 2007, annual manufacturing capacity was 5.5 gigawatts. By the end of 2009 it will be between 11.5-13 GW with further escalation into 2012, a consensus estimate of analysts suggests, with plant utilization at about 60%.

Polysilicon prices have collapsed to about $65 a kilogram from the $400/kg heyday seen in 2007 and 2008. This should be good for solar cell makers' input prices, but long-term supply contracts were reasonably common so the full benefit hasn't been fully felt.

Adding to woes, demand has dropped off after Spain curtailed solar tariffs and subsidies last year.

Storm

So this is as close as it gets to a perfect storm, one that should weed out the weak as overleveraged and inefficient makers wither....MORE

A similar story at Investopedia:

Solar Stocks Getting Burned

The solar stocks have been under pressure recently, with many threatening to break under key support levels. This was one of the groups that held promise as a new market leader with the election of President Obama and promises of energy independence. While the solars have experienced a few impressive rallies since the election, many are currently below election-time levels and are threatening to drop even lower.

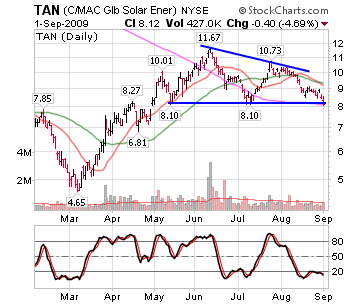

The Claymore/MAV Global Solar Energy Index ETF (NYSE:TAN), which can be used as a proxy for the sector, is currently testing a critical level. TAN has been setting lower highs as it pulls back from its June high of $11.67. While technically TAN remains in a consolidation, some of the individual names in this space are already breaking down, which could be hinting at a failure for TAN to hold these levels.

Source: StockCharts.com

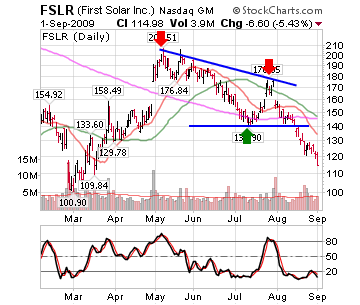

First Solar, Inc. (Nasdaq:FSLR) for instance, had a high volume gap in late June that ignited a nasty downturn. FSLR was looking much like TAN is currently, setting lower highs while remaining in a consolidation. However, FSLR broke under the consolidation and continues to freefall lower. While FSLR is probably ready for a corrective move higher, substantial damage has been done to this pattern, and it appears that FSLR is in a new intermediate downtrend. (For more, see Spotlight On The Solar Industry.)

Source: StockCharts.com

The chart for Energy Conversion Devices, Inc. (Nasdaq:ENER) looks even worse than the one for FSLR. ENER has been steadily setting lower highs and lower lows and recently broke under a base it had formed. This breakdown has led ENER to trade at multiyear lows. This breakdown is occurring on higher volume, so the picture is looking bleak for ENER....MORE