Wage Deflation in Our Midst

...Most pundits who crow about green shoots and about an inventory restocking in the third quarter giving way towards some sustainable economic expansion live in the old paradigm. They don’t realize, for whatever reason, that the deflationary aftershocks that follow a post-bubble credit collapse typically last for 5 to 10 years. Businesses understand better than the typical Wall Street or Bay Street economist and strategist that everything from order books, to output, to staffing have to now be restructured to adequately reflect a permanently lower level of leverage in the economy.Indeed, by our estimates, there is up to another $5 trillion of household debt that has to be eliminated in coming years and that process is going to require that consumers go on a semi-permanent spending diet. Companies see this, which is why they are not just downsizing their payroll, but have also cut the workweek to a record low of 33.1 hours. Fewer people are working and those that are still working have seen their hours dramatically cut this cycle....

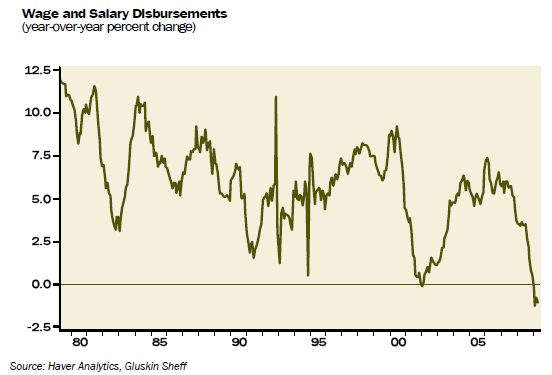

WAGE DEFLATION IS A REALITY … FAR MORE IMPORTANT THAN THE CRBAGAIN, HOW WE SQUEEZE INFLATION OUT OF THIS LEMON OF A LABOUR MARKET IS A VALID QUESTION.

When the recovery does come, the record number of people that have been pushed into part-time work are going to see their hours go back up, which will be good for them, but not so good for the 100,000 - 150,000 folks that will be entering the labour force looking for work with futility. The unemployment rate is probably going to rise through 2010, which is going to pose a challenge for incumbents seeking re-election in the mid-term voting season....MUCH MORE