From Bond Vigilantes, October 15:

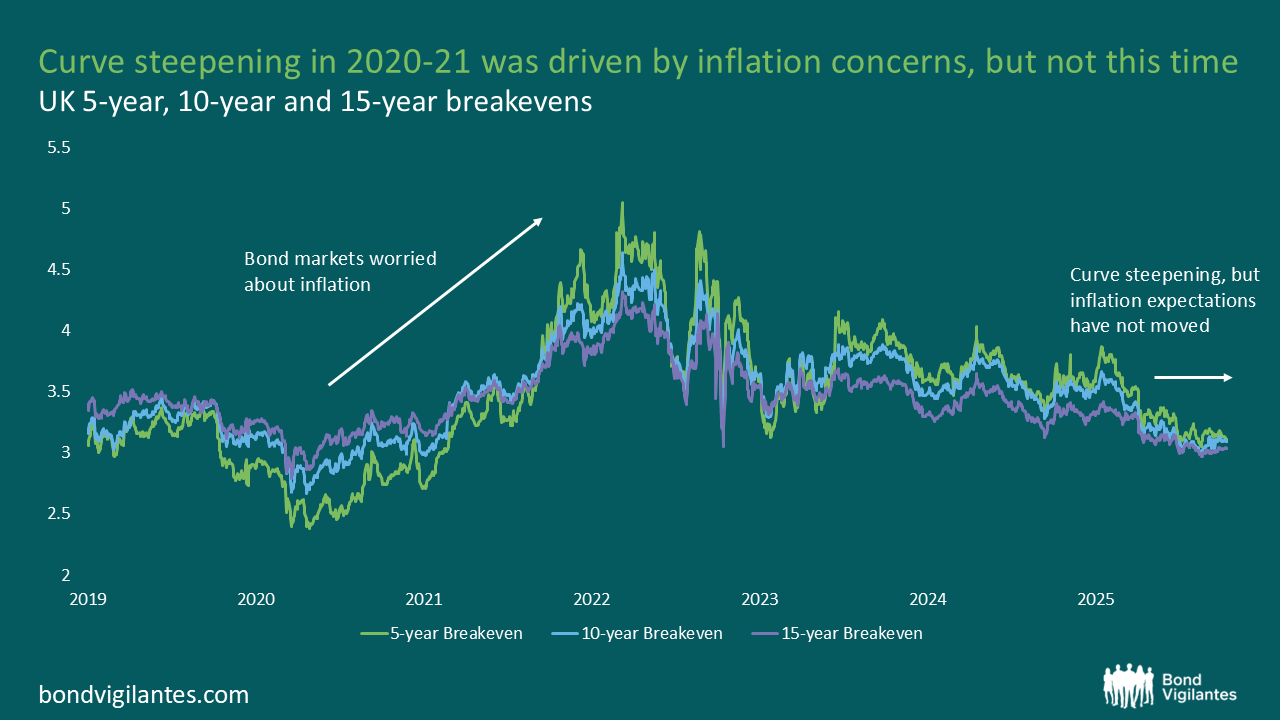

In 2020, the bond market awoke from a decade-long slumber and moved long-dated bonds higher, in what we call a curve steepening, even whilst short-end rates were (possibly) at paradigm lows. It was easy to look at this steepening move as being driven by the quite justified cutting of interest rates in response to the global pandemic and the seizure in the global economy that took place, and therefore to stop there and ignore any deeper or more subtle message. Looking back at this move, there was an important increase in inflation breakevens, which are simply bond market inflation expectations. You might say that the bond market was trying to tell central bankers that if you combine super-accommodative monetary policy rates with enormous fiscal stimulus that was (again, justifiably given the circumstances) occurring, then inflation will return.

Further, looking back at the moves in bond market inflation expectations, there was a difference in the move in expectations: 5y breakevens rose by a very significant 2.5% (so inflation was expected to be 2.5% higher each year on average for the next 5 years) between early 2020 and early 2022. 10y breakevens rose significantly too, but slightly less at 2% over the same period. These are, in bond market terms, significant repricings to say the least. The bond market was putting up its hand and saying that it was pricing large and long-term increases in inflation. Central bankers believed that this bond market move was ‘transitory’. 30yr breakevens were also up 1.5%, so the bond market clearly disagreed. The rest, as they say, is history. But the damage caused to inflation forecasting credibility may remain for a long time to come.

Source: Bloomberg (13 October 2025).

....MUCH MORE