Can you imagine the nervousness morphing into fear into terror as holders of companies without sales, earnings, and cash flows realize what they own? Good times.

From CNBC, October 3:

- Goldman Sachs CEO David Solomon said AI presented opportunities but that some investors were overlooking “things you should be skeptical about.”

- Speaking at Italian Tech Week in Turin, Italy, he said a “drawdown” was likely to hit stock markets in the coming two years.

- “I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns,” he said.

Stock markets are due a “drawdown” in the next year or two after years of being propelled to record highs by an AI frenzy, according to Goldman Sachs CEO David Solomon.

“Markets run in cycles, and whenever we’ve historically had a significant acceleration in a new technology that creates a lot of capital formation, and therefore lots of interesting new companies around it, you generally see the market run ahead of the potential ... there are going to be winners and losers,” he said at Italian Tech Week in Turin, Italy, on Friday.

Solomon pointed to the mass adoption of the internet in the late 1990s and early 2000s, which led to the emergence of some of the world’s largest companies — but also saw investors lose money to what became known as the “dotcom bubble.”

“You’re going to see a similar phenomenon here,” he said. “I wouldn’t be surprised if in the next 12 to 24 months, we see a drawdown with respect to equity markets ... I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good.”....

....MUCH MORE

Our best guess is one more fakeout shakeout to cement the rightness/righteousness of the buy-the-dip mental map and then:

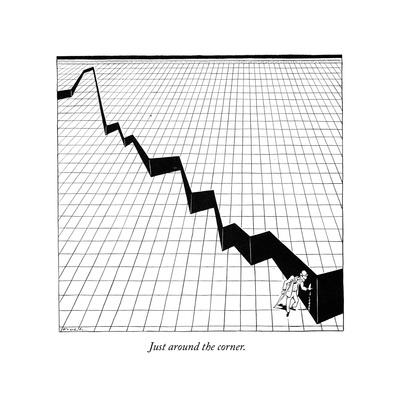

The hazards of bottom-calling were pretty much nailed by a cartoon we used as our guide and warning for readers, repeated some twenty-odd times in the six month crash during the 2008 -2009 unpleasantness: Alfred Frueh's January 16, 1932 New Yorker cartoon, "Just around the corner," playing off President Hoover's "Prosperity is just around the corner" exhortation:

The market finally bottomed on July 8, 1932, six months after the cartoon was published and 33 months after that all-time-high up on the upper left of the cartoon.

Bottom calling is hard.

And dangerous.