That's what a lot of people including yours truly are counting on.

If it doesn't happen, the human population could face real problems, far beyond simple economic stagnation.

From American Affairs Journal, Winter 2024:

Fifty years after Intel launched the microprocessor (1971) and Stanley Cohen and Herbert Boyer published the recombinant-DNA mechanism (1973) at the heart of “Biotech 1.0,” the age of cheap computing, expensive biosimilar drugs, and genetically modified organisms is coming to a close. What new general-purpose technologies might replace these engines of growth? What kinds of social and political arrangements will support or impede the emergence and deployment of those new technologies?

That we stand in the midst of a geoeconomic and geopolitical inflection point is increasingly clear, but as Walter Benjamin said, the angel of history always looks backwards. Not being angels, we lean on our asset management expertise to take the riskier path of looking forward and sketching some possible scenarios for the post-inflection future. Doing so requires outlining growth waves in capitalist economies, first generally, and then specifically for the information and communications technology (ICT) plus biotech 1.0 growth wave to understand how an internal process of decay exhausted that wave, creating the forces generating the current inflection point. This clears the way to look at a potential new package of general-purpose technologies, why those technologies and organizational formats look like solutions to current problems, and how they might get married to emerging forms of corporate and social organization. We end with three scenarios for the future. Place your bets.

Growth Waves in Economic History

Joseph Schumpeter famously argued (and contemporary neo-Schumpeterians like Carlota Perez maintain) that orthodox economics gets things wrong by focusing on equilibrium models (as in the Dynamic Stochastic General Equilibrium models most macroeconomics deploys) and on exchange rather than on production. Instead, Schumpeterians view capitalism as a dynamic process that never attains equilibrium. Moreover, revolutions in productive technologies that create eras of relatively fast growth and then stagnation characterize capitalism more so than equilibrium. These technologies emerge as a package of investment-driven changes to how things are made, moved, and marketed.

Schumpeter identified four periods of rapid growth characterized by six big technological developments: (1) A new source of cheap energy, as with coal in the mid- to late nineteenth century or oil in the mid-twentieth century. (2) A new production process based on a new general‑purpose technology, as with continuous flow production, and then continuous flow assembly line production using electrically powered equipment. (3) New investment or mass consumption goods, as with steel and then standardized consumer durables. (4) A new mode of transportation, as with steel steamships and bicycles, and then automobiles and aircraft. (5) A new form of corporate organization, as with the proliferation of vertically integrated firms with ownership divorced from management and then Alfred Chandler’s “M-form”1 multidivisional firm; related to that, new modes for financing investment. (6) Less salient in Schumpeter but nonetheless very important, as Perez has argued, new modes of social and economic governance to balance supply and demand, as with early twentieth-century cartels and then the post-1945 “Keynesian welfare states.”2

Perez expands Schumpeter’s “made, moved, and marketed” growth wave model by adding in “macro-managing” and “mindset”—that is, social dimensions like the congealing of common sense around “best production practices,” corporate organization, financing, lifestyles, and macroeconomic management. She calls the resulting package—making, moving, marketing, macro-managing, and mindset—a “techno-economic paradigm.” Each new techno-economic paradigm manifests as rapidly expanding firms, whose investments and increased sales drive economic growth, until stagnation and decline eventually set in.

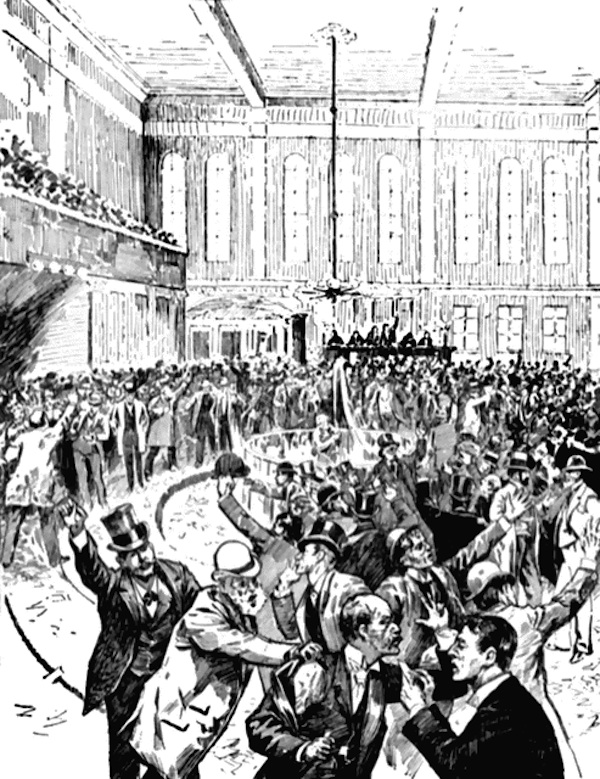

Consider the entire package of petroleum-fueled, mass-produced automobiles or consumer durables more generally (in Schumpeter’s fourth growth wave), or ICT and biotech 1.0 (in what Perez identifies as our fifth, contemporary wave). Looking at things this way divides economic growth since 1800 into six identifiable eras based on both hard and social technologies, which figure 1 displays.

The fifth, current techno-economic paradigm began in 1971 with Intel’s first microprocessor, though computing would take decades to achieve macro significance. The consistently falling costs of semiconductors opened up increasingly vast fields for the computing, electronics, and software industries. The chemical engineering skills of the electronics, and specifically semiconductor, industry also fed into the pharma sector’s role in growth over this period. The exemplary consumer product of this era is the smartphone, which combines all prior major electronics, communications, and computing equipment into one device.3 The Cohen and Boyer recombinant DNA process also opened up an era of bioengineering, replacing traditional drug research and plant breeding or hybridization methods with a relatively more targeted manipulation of genomes. Boyer would later help found Genentech, the first of a wave of new biotech firms in the pharmaceutical and agricultural space. Here, exemplary products were human insulin and herbicide‑resistant soybeans.

As Max Weber might put it, these technologies were ethically neutral. What was crucial was the new form of corporate organization wrapped around these technologies, because that drove growth while changing the distribution of income and production globally. U.S. courts and Congress, pressured by litigants in the new knowledge sectors (and some old sectors, such as hospitality), generated a series of changes in U.S. law around vertical ties and intellectual property (IP) rights. The Reagan administration’s weakening of protections for unions and legal victories for the International Franchise Association were integral to the development of the current paradigm.4 Changes to American franchise law meant that leading firms exercising high levels of control over their various suppliers would no longer be ruled illegal on antitrust grounds. The application of IP law to software, more robust trademark protection, extended copyright lengths, and the export of U.S. IP legal protection to other economies through trade deals also underpinned the success of corporate strategies focused on generating profit from IP ownership.

Franchises became the dominant form of corporate organization in this era. The old, vertically integrated firm structure gave way to a de jure vertically disintegrated tripartite structure that could take domestic or global expression. Three types of firms populated that structure. Lead firms, which often exercised de facto control over the entire chain, possessed significant human capital in a relatively small number of (highly compensated) employees, and used them to generate a colossal IP portfolio.5 These firms then outsourced much of their production to two kinds of firms: second-layer firms, which are more capital-intensive, and third-layer firms, which are labor-intensive and produce undifferentiated goods and services....

....MUCH MORE