From the Food and Agriculture Organization of the United Nations, November 3:

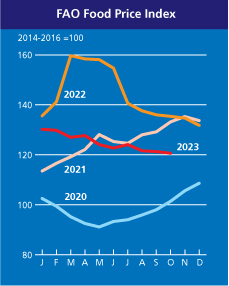

FAO Food Price Index continues to drop, but at a slower pace

» The FAO Food Price Index* (FFPI) averaged 120.6 points in October 2023, down 0.7 points (0.5 percent) from September, continuing the downward trend and standing 14.8 points (10.9 percent) below its corresponding value a year ago. The slight drop in October reflects declines in the price indices for sugar, cereals, vegetable oils and meat, while the index for dairy products rebounded.

» The FAO Cereal Price Index averaged 125.0 points in October, down 1.3 points (1.0 percent) from September and as much as 27.3 points (17.9 percent) from its value a year ago. International wheat prices fell by 1.9 percent in October, reflecting generally higher-than-earlier-anticipated supplies in the United States of America and strong competition among exporters. By contrast, international prices of coarse grains firmed marginally, increasing by 0.6 percent month-on-month. Thinning maize supplies in Argentina placed upward pressure on world maize prices, but this was capped by higher seasonal supplies in the United States of America, where the harvest progressed, and a strong export competition from Brazil. Among other coarse grains, world sorghum prices rose in October, while barley prices fell. International rice prices dropped by 2.0 percent month-on-month in October, weighed by generally passive global import demand.

» The FAO Vegetable Oil Price Index averaged 120.0 points in October, down 0.9 points (0.7 percent) from September, marking the third successive monthly decline and standing 31.3 points (20.7 percent) below its value one year ago. The marginal fall in the price index chiefly reflected lower world palm oil prices, more than offsetting higher prices of soy, sunflower and rapeseed oils. International palm oil prices continued to drop in October, mainly due to seasonally higher outputs in leading producing countries as well as protracted subdued global import demand. By contrast, world soyoil prices rebounded after declining for two months in a row, underpinned by robust demand from the biodiesel sector, particularly in the United States of America. In the meantime, international sunflower oil quotations rose slightly on firm global import purchases, while rapeseed oil also increased moderately on reduced crop prospects in Canada.

» The FAO Dairy Price Index averaged 111.3 points in October, up 2.4 points (2.2 percent) from September, following nine months of consecutive declines, but still down 28.0 points (20.1 percent) from its value one year ago. In October, world milk powder prices increased the most, principally driven by surges in import demand for both near- and longer-term supplies, especially from Northeast Asia. Tight milk supplies in Western Europe and some uncertainty over the impact of the El Niño weather conditions on the upcoming milk production in Oceania added further upward pressure on prices. World butter prices also rose due to increased retail sales ahead of the winter holidays in Western Europe and higher import demand from Northeast Asia. By contrast, international cheese prices dropped slightly due to the impact of the continued weakening of the Euro against the United States dollar and increased exportable availabilities in Oceania.

» The FAO Meat Price Index* averaged 112.9 points in October, down slightly (0.7 points, or 0.6 percent) from September, marking the fourth consecutive monthly decline, and standing 3.9 points (3.4 percent) below its value a year ago. In October, international pig meat prices fell for the third consecutive month, principally driven by the persistently sluggish import demand, especially from some East Asian countries, with further downward pressure stemming from high exportable availabilities in some leading suppliers. By contrast, world poultry meat prices rebounded slightly, as avian influenza outbreaks continued to constrain supplies from several world leading suppliers amid robust consumer demand due to the relative affordability of poultry meat. International bovine and ovine meat prices also increased marginally, reflecting the persistent, robust import demand from some leading importers, notwithstanding ample supplies of bovine meat from Australia and Brazil and ovine meat from Oceania....

....MUCH MORE