We'll have more on the Chinese government efforts to date next week but the TL;dr is: it's not enough. The property sector is so big that the hole in it is so big that it will take over a trillion dollars just to stabilize, much less return the asset class to a position of driving the economy.

Here's some background from a year ago thatt has stood us in good stead as far as understanding the economy of the Eastern Giant:

Thursday, December 1, 2022

What If Our Understanding Of China's "Zero Covid" Is 180 Degrees Wrong?

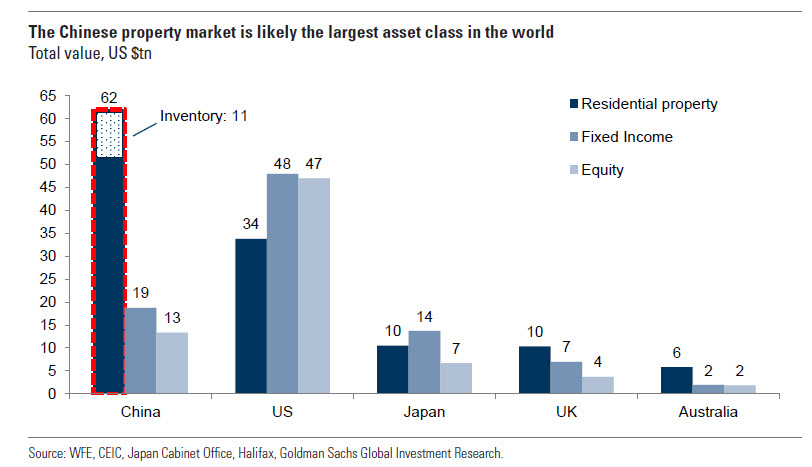

One story that has dropped from the headlines is China's property market, in part because the government has ordered the banks to open the nozzle on the liquidity fire hose. I think the official numbers are up to around $200 billion. But that's not even the amount of China Evergrande Group's debt ($300 billion), much less the rest of the sector, which itself is just a fraction of the total asset class which Goldman last year estimated to be the largest in the world at $62 trillion (but deflating fast)

What if the required rescue is 10 times the amount officially reported as being injected?

China would run into the same dilemma the U.S. faced when injecting $5 - 6 trillion into the American economy: If the powers-that-be allowed the economy to remain open as the liquidity poured in the resulting inflation would have been 40 -50% and would have hit the population within weeks. In China's case the rioting would have made the current protests look look like a convivial, collegial discussion group.

The lockdowns allowed the U.S. to bleed the inflation into the economy at a reduced rate, CPI is up 14% since January 2021, effectively deflating the Federal debt by a like amount or $4.2 trillion, equal to around 2/3 of the 2020 -2021 spending and liquidity injections.

The Chinese "zero covid" lockdowns make no sense from a public health standpoint and as one of my favorite China experts says, "Chinese are very smart people, there must be something else going on that you roundeyes don't see. And then he laughs when I tell him he is a racist.

On the other hand here is the causality as usually presented, from Time Magazine, December 1:

China’s Zero-COVID Trap

Protesters in China have demanded an end to the country’s draconian zero-COVID policy—a pandemic prevention strategy that President Xi Jinping claims has kept his people safer than less stringent measures taken by other nations—as the suffering it’s wrought is becoming increasingly unbearable.

Experts have said it’s unlikely the government will outright end zero-COVID anytime soon, though it may continue to tweak the policy. But even if Xi wanted to ditch the strategy altogether, as some localities are reportedly starting to do, that could bring about even more misery.

Zero-COVID—defined by city-wide lockdowns, mass testing, and enforced quarantines—was once a paragon of the containment approach toward the coronavirus pandemic. To this day, Johns Hopkins University data shows China to have the lowest COVID-19-related deaths per capita worldwide. The country’s death toll, according to the World Health Organization, is only at 30,205, compared to the more than a million deaths in the United States—though questions have been raised about the accuracy of China’s official data reports.

Over nearly three years, however, the same measures meant to protect China and its people have also exacted a devastating toll. Residents in some areas have found themselves scrambling for food and other resources, and others have blamed zero-COVID for deadly delays in emergency responses. Mental health in the country has plummeted, while the economic fallout, domestically and globally, continues to grow....

....MUCH MORE

If we can believe the 30,205 deaths number, we can probably believe the liquidity injections numbers.

If not, not.

And the headliner, from Asia Times, November 24:

Property developer shares surge on ‘white list’ loan program but buyers still reluctant to enter markets when prices keep falling

The Chinese government is reportedly drafting a white list of around 50 major property developers that will be allowed to borrow from banks more easily to maintain their construction work, a move that has at least temporarily lifted beleaguered property company shares.

The People’s Bank of China (PBoC), the National Administration of Financial Regulation and the Chinese Securities Regulatory Commission met on November 17 and jointly planned to offer new loans to certain property developers in the first quarter of 2024, according to some Chinese media.

Hong Kong-listed property developers’ shares have surged by 20-30% over the past few days on the news. Longfor Group’s shares have gained 22% this week while Country Garden’s shares have skyrocketed 36%. Sunac China is up 29%.

Meanwhile, Bloomberg reported on Thursday that China may allow banks to offer unsecured short-term loans, or so-called working capital loans, for the first time ever to some qualified developers.

Citing unnamed sources, the report said the new financing facility would be available for day-to-day operational purposes, helping property developers to free up capital for debt repayment.

Some property analysts said the new bank loan facility will help large property developers improve their cash flow while leaving smaller developers in the cold. They said the Chinese are still reluctant to purchase homes when prices keep falling.

On November 8, an article with the title “Property prices in Shenzhen are collapsing” was widely circulated online.

It said the average property price at Huajun Garden in Baoan district has dropped 57% to 1.85 million yuan (US$259,843) per unit from a peak of 4.2 million yuan a few years ago. Property prices have fallen 41% to 2.4 million yuan at Youlin Apartment in Nanshan district and decreased 46% to 3.9 million yuan at Longyueju in Longhua district....

....MUCH MORE, keep reading, the bit after "Financing the Black Hole" gives some indication of the size of the challenge.