Two from ZeroHedge. First up the headliner, November 14:

Wall Street Reacts To Today's CPI Shocker Which Was The Biggest "Market Surprise" Of 2023

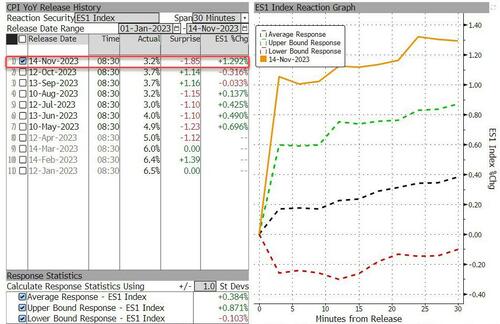

After several months of upside surprises, markets were expecting more of the same. Instead, they got the biggest across the board CPI miss in a year, and indeed if one looks at the market reaction to the print it is shaping up as the biggest "positive surprise" response this year.

As shown in the chart below, the spike in stock futures in the first 30 minutes after the release was the largest reaction to a CPI print in 2023 based on data compiled using the Bloomberg’s Market Impact Monitor. For the dollar, this is the largest drop and absolute move since January while gold saw its biggest gain post CPI since July.

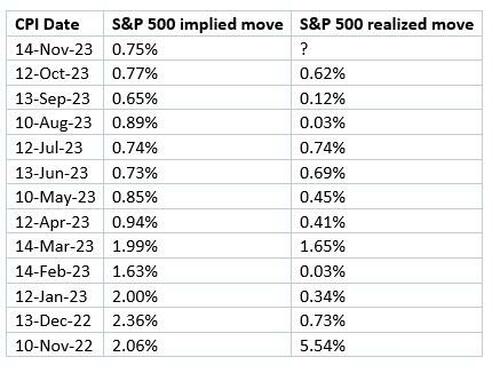

Considering options were pricing in just a 0.75% move today, there will be a lot of very unhedged, and hurt, traders.

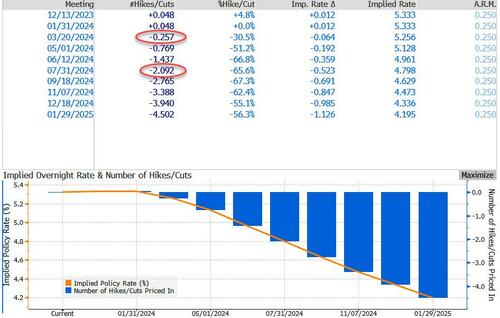

And while even the WSJ's Nikileaks hinted that the Fed is now done with hikes, and the market pricing in some rate cuts as soon as March and around 2 cuts by July...

... Bloomberg's Chris Antsey made a good point: "if the Fed does stay on hold in December, then by the January meeting, it will have been on hold for half a year. At that point, you would have to assume any move to raise rates again would be effectively a new cycle. Hard to see how they would think one 25 basis point increase would do the trick. We’d be in another cycle of tightening."

And we will be, just as soon as China panics and injects trillions into the economy to avoid a full-blown revolt, some time in late 2024 just in time to send commodities soaring to record levels ahead of the US election. Until then, however, it's time to enjoy the end of the current hiking cycle as the bulk of Wall Street reactions to today's CPI print suggest.

Below we excerpt the reactions to today's CPI from several traders, analysts and strategists.

Win Thin, global head of currency strategy at BBH:

“I’m not hanging up the ‘Mission Accomplished’ banner just yet. Transportation was a big downside factor (-0.9% m/m). However, food and beverages (0.3%), housing (0.3%), and services (0.3%) are still showing solid gains. 4 cuts by end-2024? Again, ain’t happening. The market sees what it wants to see. It’s been wrong on the Fed this entire cycle.”

Ian Lyngen of BMO Capital Markets:

“This print was good news for the Fed and offers evidence that monetary policy is still effective and impacts the real economy with a lag -- the fundamental things apparently still apply. This takes a rate hike off the table in December and reinforces our call that July was the last hike of the cycle and the process will now shift to the Fed attempting to delay cuts as long as possible.”

Anna Wong of Bloomberg Economics:

“October’s surprisingly soft core CPI reading will increase Fed officials’ confidence that rates are sufficiently restrictive. Still, core CPI readings will need to continue on this path for several more months for the FOMC to declare a definitive end to the rate-hike cycle. Looking at the 12-month change in core inflation, it’s still running at twice the pace of the Fed’s 2% target. Overall, inflation is still a long way from the target — and the road there is sure to be bumpy.”....

....MUCH MORE

And earlier:

CPI Unexpected Misses Across The Board Due To Plunge In Gas Prices, Core Inflation Lowest In Over 2 Years

Following two months of hotter than expected prints (driven by surging energy prices and healthcare methodology changes), the October CPI print was expected slow materially from the previous month (from 3.7% to 3.3% on headline) even if core was expected to remain unchanged at 4.1%. What we got, however, was a miss in CPI across the board with both headline and core prints coming in below expectations on both a sequential and annual basis.

Starting with the headline CPI, it came in at 3.2%, below the 3.3% expected, while MoM CPI also missed expectations, printing unchanged (0.0%), below the consensus of a 0.1% print, and sharply below last month's 0.4% print.

A similar picture emerged on core CPI, where the October MoM print was 0.2%, below the 0.3% consensus estimate and down from the 0.3% increase in Sept, while YoY managed to drop from 4.1% to 4.0% missing expectations of an unchanged print, and the lowest annual increase since Sept 2021.

According to the BLS, the index for shelter continued to rise in October (more below) offsetting a decline in the gasoline index and resulting in the seasonally adjusted index being unchanged over the month. The energy index fell 2.5 percent over the month as a 5.0-percent decline in the gasoline index more than offset increases in other energy component indexes. The food index increased 0.3 percent in October, after rising 0.2 percent in September. The index for food at home increased 0.3 percent over the month while the index for food away from home rose 0.4 percent....

....MUCH MORE

For comparison/contrast here is our Sunday November 12 post "Cleveland Fed Inflation Nowcast: CPI 0.07% Month-over-Month; 3.28% Year-over-Year". The introduction:

This may be the trough in the inflation numbers, with upticks to start again with the December report released in January 2024. First though the various series tracked by the Federal Reserve Bank of Cleveland, updated each working day....