We last mentioned Smead as part of March 30's "Fisher Investments Moves to Texas Over Taxes":

Another shop we follow, deep value (sometimes very deep value) mavens Smead Capital Management left Washington State a few years ago...

And from Smead Capital Management, two of their four missives from last month. First up, the headliner, March 1:

Dear fellow investors,

As a young stockbroker in the 1980s, I was very enamored with T. Boone Pickens. Pickens recognized the huge value that built up in common stocks in the inflationary 1970s and began to use the financial backing of the Junk Bond King, Michael Milken, to become an activist on Wall Street. His little company, Mesa Petroleum, started investing in undervalued large cap oil stocks and threatened to do large leveraged buyouts (LBOs) with the assistance of Milken’s firm, Drexel Burnham Lambert (my employer).

Pickens said, “It is cheaper to drill for oil on the New York Stock Exchange than it is to drill directly.” After reading Pioneer Natural Resources CEO Scott Sheffield’s comments recently, we at Smead Capital Management believe we’ve reached that point again:

“Crude oil prices likely will climb to ~$100/bbl by this summer and end the year in the low 90s, Pioneer Natural Resources (NYSE:PXD) CEO Scott Sheffield said Thursday during the company’s post-earnings conference call.

Sheffield nevertheless reiterated that capital discipline will remain the priority, and Pioneer’s (PXD) shareholders have not changed their view on that.”

Intense political pressure from Federal and State levels of government is scaring oil and gas companies away from drilling for environmental reasons! Since common stock investors want to benefit from scarcity, Sheffield is not alone in this attitude. If he is correct, the largest capitalization oil companies should be on the hunt to replenish oil reserves via acquisition....

....MUCH MORE

And March 7:

Musings from Buffett’s Letter

Dear fellow investors,

There were many good things to think about from Warren Buffett’s letter to shareholders which came out recently. In this piece, we’d like to drill down on two subjects that Buffett highlighted.

“Warren and I hated railroad stocks for decades, but the world changed and finally the country had four huge railroads of vital importance to the American economy. We were slow to recognize the change, but better late than never.”

The railroads were affected by the economy, but when it got down to four players, the behavior of the players and the position of the largest player became very favorable to Warren Buffett and Charlie Munger. The economic “importance” created strong economics for investing.

The home building industry has changed dramatically in the aftermath of the liar loans and investment mania of 2003-2006. Hundreds of thousands of houses were built into unfavorable demographics and the failure of prices in 2007-2009 poisoned the financial system. Never let a good crisis go to waste, a political strategist once said.

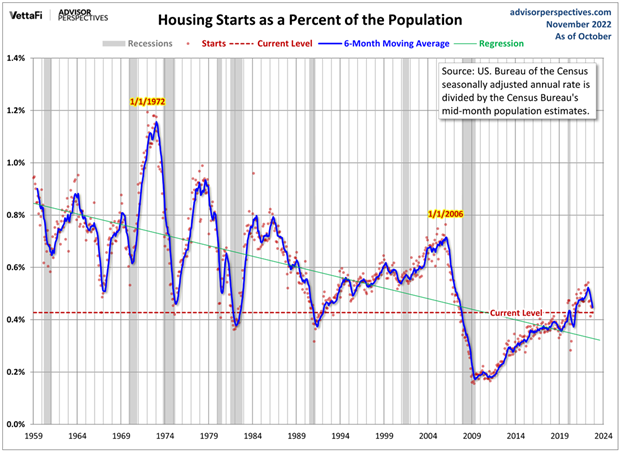

Out of that debacle came the biggest housing depression since the 1930s. We only built 310,000 homes in 2010 in a 300-million-person U.S. economy. As you can see below, this was a legendary low point in home building divided by population:

Source: Source: Advisor Perspectives as of October 31, 2022.

The low point in home builds flushed the nation of small-time/Mom and Pop builders. The second thing it did was convince the largest builders, D.R. Horton (DHI) and Lennar (LEN), that NVR’s (NVR) strategy of buying lots in the late stages of development via options was superior to leveraging their own balance sheet to develop raw land. Eliminating the leverage in downcycles takes a great deal of cyclicality out of the equation....

....MUCH MORE

I chose those two because two of Berkshire Hathaway's portfolio holdings, Chevron and Occidental are up around 4% today on the OPEC+ news.

Here are some press mentions of Smead:August 23, 2022

Investor’s Business Daily: Cole Smead, CFA on Buffett and Oil and Gas Stocks

August 19, 2022

The Wall Street Journal: Cole Smead, CFA on Berkshire’s Occidental Play

August 19, 2022

CNBC: Cole Smead, CFA on Warren Buffett Buying up to Half of Occidental Petroleum (OXY)

April 28, 2022

Reuters: Bill Smead on Berkshire Hathaway and Energy

There are 33 pages of that stuff.

And some of our links to Smead Capital:

"Ramblings From My Idol, Charlie Munger"

Glam Tech: "Humpty-Dumpty Stock Market"

The Sum-of-the-Parts Argument For Volkswagen Longs

Caveats up front:1) Much of the value in VW is contingent on the correct evaluation of Porsche (this is where financial engineering in the form of a pair trade [it is not an arb, it is not an arb] might be of some value)

2) It can sometimes take a very long time for the market to come around to your way of thinking, you have to understand this going in or you are apt to get bored/lazy/scared and sell before the perceived value has manifested out of your head and into the price, to get a bit new-agey....

Oil & Gas Equities: "Love Is In The Air" (CLR; OXY)

This is a repost from July 16, 2022 intended to show the thinking of a couple guys who seem to understand the larger dynamics of the oil & gas business.

And quite a few more but not 33 pages worth.