From Bill Smead, founder of Smead Capital Management, November 8:

The era of the dynamic sales growth tech company, with a religious quality to its leadership, appears to be over. Who are these mega-dynamic leaders? What was the key to their extended success in business and the stock market? How long will it be before these former powerhouse stocks get interesting again? In other words, when will Humpty-Dumpy get put back together again?

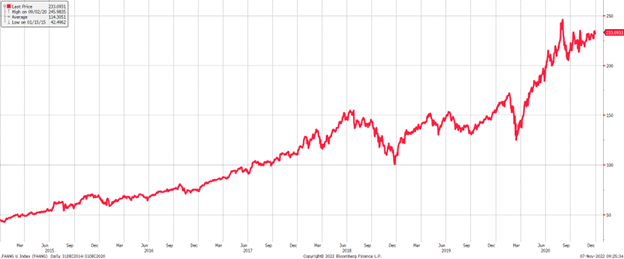

The period from 2014 to 2020 was dominated by the stock market success of the FAANG stocks. These technology companies were heavily promoted by charismatic leaders like Mark Zuckerberg, Jeff Bezos, Tim Cook, Reid Hastings and Sundar Pichai. They laid out aggressive revenue growth targets and hit them. In the process, they developed a cult-like following of growth stock and passive investors.

Source: Bloomberg

These men brilliantly established the rules of the game they played. Zuckerberg (in social media by way of a Harvard dorm), Bezos (by way of DE Shaw’s hedge fund), and Reid Hastings (the Pied Piper of movies by mail) seized the era and never made any effort to temper the dreams of cult-like investors who enjoyed their products. Humpty-Dumpty never had a great fall.

Antitrust laws existed, but none were used on their monopoly positions. Second, revenue growth was the key benchmark, rather than profitability. Third, the more growth targets they hit the more devotion they received from investors.

What perpetuated this game so long were four things. 1) The uninterrupted nature of their sales growth, 2) an extended and historic bull market in stocks, 3) a substantial downward movement of interest rates, and 4) the way the COVID-19 lockdowns accelerated their sales growth with home imprisoned customers....

....MUCH MORE

Smead are deep (sometimes very deep) value investors. But as noted in our intro to our last visit in "The Sum-of-the-Parts Argument For Volkswagen Longs":

Caveats up front:

1) Much of the value in VW is contingent on the correct evaluation of Porsche (this is where financial engineering in the form of a pair trade [it is not an arb, it is not an arb] might be of some value)

....For fund managers, assuming the analysis is correct, it all comes down to "How long does it take to play our" or in the words of a very wealthy investor I was talking to as he laughed about the latest 89-page investment thesis he had been sent: "I don't want all this, I want the answers to three questions: What's the upside? What's the downside? What's the time frame?".