Of course it was.

From Dario Perkins at TS Lombard:

There is beautiful irony in macroeconomics, a sort of inherent Minsky dynamic, or universal Goodhart law, that means that just when everyone thinks something is definitively true, it turns out to be spectacularly false. In fact, worse than that, the false belief usually sows the seeds of its own destruction. Our whole pseudo-science is susceptible to that famous Mark Twain quote “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so." We see this most clearly in the long pendulum swings between fiscal and monetary orthodoxy. Just when the Keynesians think they have won the argument, they have to face their historic nemesis - stagflation. And when policymakers think they can solve all the world’s problem with monetary policy alone, they always end up in some version of the liquidity trap. We also see these dynamics on a more granular level. Ignore the banking system, as the authorities did in the early 2000s, find yourself in a banking crisis. Regulate the banks, and push financial bubbles into shadow banking and institutional investors. Financial markets are viral. To control is to distort.

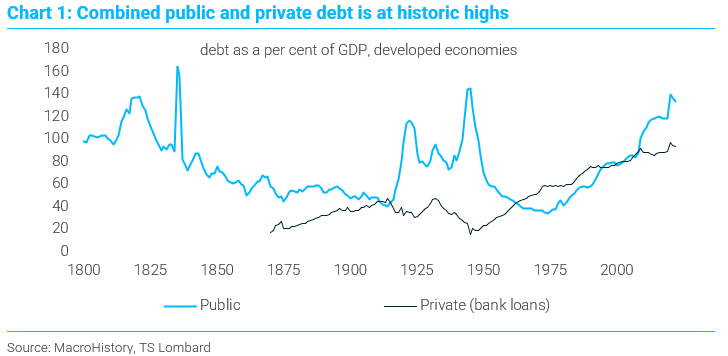

It is with this sense of irony, bordering on superstition, that we should rethink everything that has happened over the past decade. The 2008 crisis shocked everyone. As an industry, financial markets suffered a sort of collective PTSD. Investors spent the next decade looking for black swans that never arrived. The euro crisis in 2010. The debt limit in 2011. The euro crisis again in 2012. Oil in 2014. China in 2014, and in 2016, and in 2019, and again 2021. Mallmageddon in 2018. The thing that happened in repo markets – that nobody fully understood – in 2019. Sellside economists analyzed every potential threat in excruciating detail, looking for that one problem their clients feared most – “another Lehman moment”. And policymakers reacted in the same, hypersensitive way to every potential market threat. The authorities had their own PTSD to deal with. Nobody wanted to return to the crisis of 2008, with its chaotically arranged market communiques and rescue packages finalized at 4am. At every opportunity, central banks cut interest rates and added more QE. Deep down they knew these policies would do little to help their economies, but they seemed very effective at propping up asset prices. And with inflation showing no obvious signs of life, there was no real cost to this endless monetary lifeline. What harm would it do?

Chart 2 Time to monetize the debt....

....MUCH MORE

HT: FT Alphaville's Further Reading post