Via ZeroHedge:

....And then there are the experts, traders and analysts. Courtesy of Bloomberg here is a recap of kneejerk responses to today's cooler than expected CPI prints.

Max Gokhman, AlphaTrAI

“Here’s my hot take: We expected that there would be deceleration of core goods prices, but seeing services slump too was a bigger bonus than any banker will get this year. That said, this won’t budge the Fed to rethink a 50bp hike in December, so traders curb their initial enthusiasm.”

Jim Bianco, founder of Bianco Research:

"This is only the third time in the past 20 months that inflation has come in below forecast." He says he cannot recall an immediate 2% plus move in US stock futures off an indicator like this: “It just goes how focused and how important this data is. This is the most important event of the month, for all financial markets.”

Charlie Bilello, CEO of Compound Capital Advisors

October CPI report vs. September CPI report: Lower YoY % increase: Gas Utilities, Gasoline, Electricity, Food at Home, New Cars, Overall CPI, Medical Care, Apparel, Used Cars; Higher YoY % increase: Fuel Oil, Transportation, Food away from Home, Shelter

Anna Wong, Chief Economist at Bloomberg Economics

“The soft October core CPI print offers Fed doves a powerful justification to slow the pace of rate hikes going forward. More widespread disinflation across goods sectors, and a measurement quirk in medical care services -- factors we expect to continue in the months ahead -- helped bring down inflation in October. Still, robust services inflation keeps alive the threat that inflation expectations will become unmoored, which would justify a higher terminal rate. Bloomberg Economics’ baseline is for the FOMC to raise rates by 50 basis points at its December meeting.”

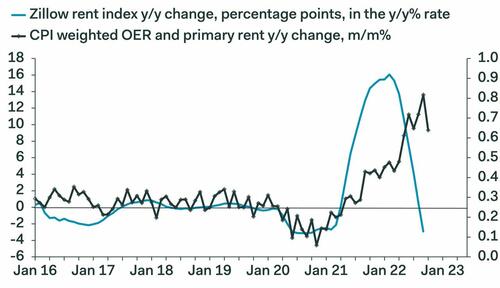

“Shelter costs grew at a robust 0.8% pace in October. The good news is that the monthly gains in rent of primary residence and owners’ equivalent rent of residence both slowed, after several months marching higher. We expect these two important shelter components to peak in the next few months, but we don’t expect the year-over-year increase to peak until 1H 2023.”

Ian Shepherdson, Chief Economist at Pantehon Macro

"The fever is breaking in rents"

Rubeela Farooqi, Chief US Economist, High Frequency Economics:

“Overall, the 12-month changes in both headline and core consumer prices remain uncomfortably high and we would hesitate to overemphasize one report. However, the data will be welcome news for the FOMC, finally showing some response in prices to 375-bps of rate hikes.”

Ellen Zentner, chief economist at Morgan Stanley

“The softening of core inflation in the October release is welcome news for the Fed. Policymakers have indicated that their preferred next move would be a step down to a 50 basis-point rate increase at the December FOMC. Signs of deceleration will help Fed officials moderate the reduction in the pace of tightening, though a stronger than expected December payroll print (300k+) could still complicate the issue at the margin.”

....MUCH MORE