For our purposes the key is the dollar. Which of course is based on relative interest rates.

If the U.S. continues tightening, a revisit of the 114.78 high on the dollar index is in the cards and any commodities that are quoted in dollars (and in approximate supply/demand balance) will trade lower.

From ZeroHedge, November 2:

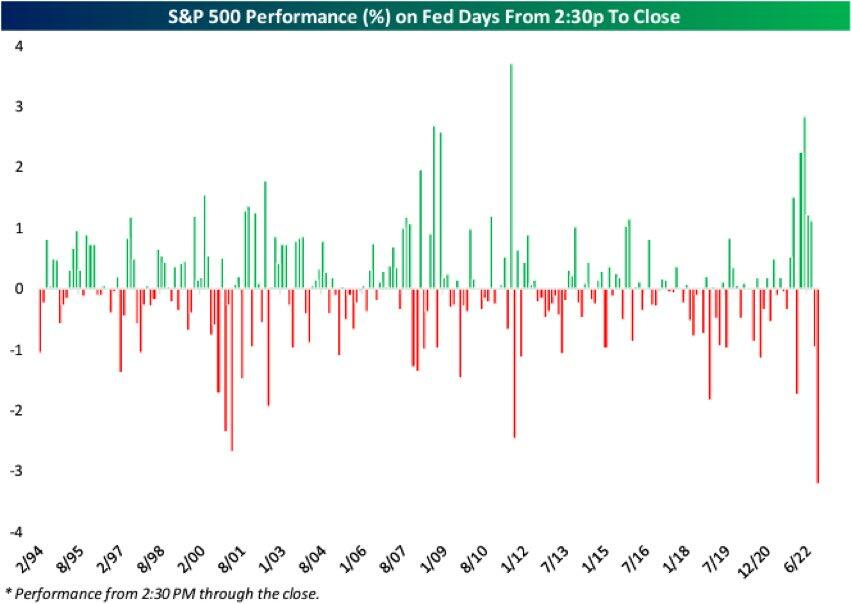

It will live in the annals of market infamy as the day the Fed rugpulled the market, when first a very dovish statement sparked a frenzied buying spree, only to be followed by a blistering, hawkish assault on the bulls during Powell's press conference, leading to risk freefall, and the worst final 90 minutes of a Fed day in history, according to Bespoke.

In his EOD wrap, Goldman tradaer John Flood agrees that today was a Dr Jekyll/Mr Hyde kinda day, when the Fed statement, ostensibly written by the dovish Lael Brainard, sparked a risk-on buying frenzy, only to crater when Powell said it was not only premature to think about pausing rates, but said that “incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected” suggesting that the dots will be revised materially up in December.

75bps it is (for the 4th consecutive meeting). Table now set for a potential pull back to 50bps in Dec (market was already pricing this in coming into today). Official 2pm statement was indeed dovish: The Fed said it will consider existing tightening steps, the lagged effect of policy, and “economic and financial developments” (all dovish phrases).

However, during the presser Powell was quite hawkish: “VERY PREMATURE TO THINK ABOUT PAUSING RATE HIKES” was the line that really stood out to me. After this comment we saw Macro HFs press shorts and L/Os outright cxl bids in singles that they had layered lower in the mkt. We had steady L/O supply in supercap tech all session (again). Our U.S. equities franchise ended with -449bps sell skew vs 30d avg of -135bp sell skew. Growth factor -$838mm notional sell skew which is most dramatic since 8/22/22 and in 79th percentile vs previous 52 weeks.

As the selling accelerated, all support levels were taken out:

S&P 50dma of 3822 didn’t provide any support. CTAs and Corporates can’t prop this tape up on their own. Lower for longer now when it comes to US stocks post today’s developments.

For Flood's downbeat conclusion to today's market action, he uses Jpow's own summation of today's message:

"Okay. So I would also say it's premature to discuss pausing. It's not something that we're thinking about. That's really not a conversation to be had now. We have a ways to go. The last thing I'll say is that I would want people to understand our commitment to getting this done and to not making the mistake of not doing enough or the mistake of withdrawing our strong policy and doing that too soon. I control those messages. That's my job."....

....MUCH MORE

Does the Fed raise rates higher/longer than other Central Banks?Question asked and answered.