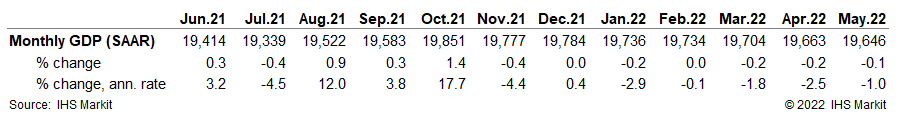

On the economy, IHS Markit's July 4 report on their monthly GDP estimates:

US Monthly GDP Index for May 2022

Monthly US GDP declined 0.1% in May on the heels of 0.2% declines over the prior two months. The April decline was revised materially lower from a previously estimated, 0.5% increase. The decline in May reflected declines in personal consumption expenditures, fixed investment (residential and nonresidential), and net exports that were partially offset by an increase in nonfarm inventory investment. Averaged over April and May, monthly GDP was 1.4% below the first-quarter average at an annual rate. Implicit in our latest estimate of a 1.5% annualized decline of GDP in the second quarter is roughly no change in monthly GDP in June.

Our index of Monthly GDP (MGDP) is a monthly indicator of real aggregate output that is conceptually consistent with real Gross Domestic Product (GDP) in the National Income and Product Accounts.

....MUCH MORE

note that the first two months of Q2, April and May continued the trend of lower Monthly GDP (estimated) for the fifth consecutive month. BEA-reported a 1.6% decline for Q1.

Next up, snips of two of Marc Chandler's Saturday and Sunday posts (yes, he also works weekends)

July 23: The Fed and GDP: Week Ahead

....The eurozone and the US reported disappointing flash composite July PMIs. They both unexpectedly fell below the 50 boom/bust level. This warns that the Q3 has begun off with poor momentum. Indeed, as policymakers note, the path to a soft landing has narrowed. At the end of June, the Fed funds futures implied a year-end rate between 3.25% and 3.50%. Since the CPI, the market has mostly been holding at the range's upper end. However, the year-end rate pushed toward the lower end of the range after the US PMI. The data boosted the market's confidence that the Fed will have to cut rates next year. The implied yield of the June 2023 Fed funds contract is now about 23 bp lower than the December 2022 contract. The December 2023 contract is about 58 bp lower than the December 2022 contract....

....MUCH MORE

July 22: Momentum Indicators Warn of Further Dollar Weakness, but will Sellers Emerge ahead of the FOMC?

....Dollar Index: The Dollar Index pulled back after visiting a 20-year high near 109.30 on July 14. It found support around the (50%) retracement of the latest leg up that began in late June around 106.50, which was also near the 20-day moving average. It frayed after the PMI surprise. A break of 105.95 would be significant from a technical perspective. The close below the 20-day moving average (~106.55) was the first since mid-June. The momentum indicators are trending lower, and the five-day moving average may push below the 20-day moving average for the first time in over a month....

....MUCH MORE

From a U.S.-centric perspective a declining dollar raises the price of imports, of which there are many. Worldwide, it also raises the price of commodities that are priced in dollars.

Finally the Federal Reserve Board really hasn't done much of anything. As we saw last week, over the first seven weeks, the so-called quantitative tightening is proceeding at 20% of the stated goal and, in the face of of the 9.1% CPI inflation reported last month the Fed Funds target is only projected to rise to 2.5% at this week's FOMC meeting:

source: tradingeconomics.com

To repeat, in the real world the Fed has done nothing and the economy is still heading south.

It's all been, to swipe the words of former NYT reporter Neil Sheehan's epic on America's war in Vietnam: "A Bright Shining Lie."