Equities? Yeah, them too but I was thinking of this via Wall Street Silver:

This week..! pic.twitter.com/EmEZFyd5V9

— Wall Street Silver (@WallStreetSilv) May 8, 2022

And the reason I was thinking about it, from ZeroHedge:

Retail Is Puking: "This Is The 5th Biggest Sell Day On Record"

In its latest note (available to zerohedge pro subscribers) discussing the ongoing market

pukefestdynamics, Morgan Stanley's Quantitative and Derivatives group (QDS) wrote that "institutional real money plus retail have been driving more of the sell pressure and are likely to continue to drive price action in the medium-term." Echoing what we said last week, and a reversal of the pattern observed one month ago...Relentless hedge fund selling of every rally, retail buying

— zerohedge (@zerohedge) April 4, 2022

JPM Prime "From a HF flow perspective, however, there’s been a fairly strong bias to sell-the-rally (STR) as JPM Prime has seen net selling in 8 of the past 9 days" pic.twitter.com/icxcif5ymV... Morgan Stanley cautioned that retail demand has begun to slip, and retail will likely be less supportive to the broader equity market going forward:

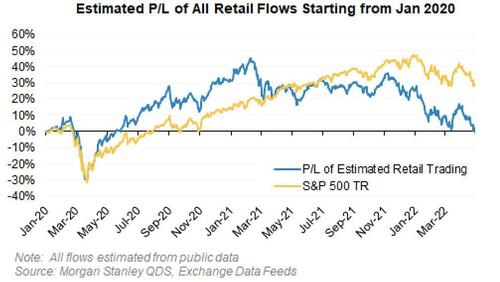

Retail demand has been weaker than expected relative to seasonal trends post-tax day, estimated retail P/L is deteriorating, and inflation is eating away at individuals’ disposable income.

The QDS conclusion: "Retail has been an important buyer of dips, and with the retail bid dissipating just a lack of buying is likely enough to create an air pocket in the medium-term."

The reason why retail has chilled on risk assets and appears completely turned off by any trading, is because all of its P&L generated since January 2020, right before the covid crisis, is now gone.

It didn't take long for Morgan Stanley to be proven right, and in an update pushed out on Monday afternoon, Morgan Stanley finds that retail is now out, estimating that "retail has now net sold $2.2bn today – that is the 5th biggest sell day on QDS records going back to 2016, with the 4th biggest sell day on Sep 4th 2020 at $2.3bn."...

....MORE

Also at ZeroHedge, their daily wrap up: