From the Federal Reserve Bank of Kansas City, May 26:

Many central banks around the world have been researching, experimenting, or developing central bank digital currencies (CBDCs). Although central banks in several emerging markets and developing economies have implemented or plan to implement a general-purpose, or retail, CBDC to promote financial inclusion and improve their payment systems, central banks in many advanced economies have not yet found a compelling case for a retail CBDC.

In recent years, interest in central bank digital currencies (CBDCs) has been increasing around the globe. Although only a few central banks have thus far implemented a retail CBDC, many banks have been assessing the need within their economies. According to the Bank for International Settlements, the share of central banks that have been researching, experimenting, or developing CBDCs grew from about 70 percent in 2018 to over 85 percent in 2020 (Boar and Wehrli 2021). The vast majority of these banks have focused on retail (or general-purpose) CBDCs.[1]

In this Briefing, we examine what motivations, if any, central banks have identified for retail CBDCs. In general, we find that central banks in emerging markets and developing economies (EMDEs), such as China, Mexico, and Nigeria, tend to be more enthusiastic about retail CBDCs and have clearer motivations for their issuance relative to central banks in advanced economies, such as Canada, Japan, and Singapore.[2] Indeed, several central banks in EMDEs have made progress in developing or implementing a retail CBDC; in contrast, many central banks in advanced economies have only undertaken technical research on a retail CBDC, and most have not developed plans to implement one.

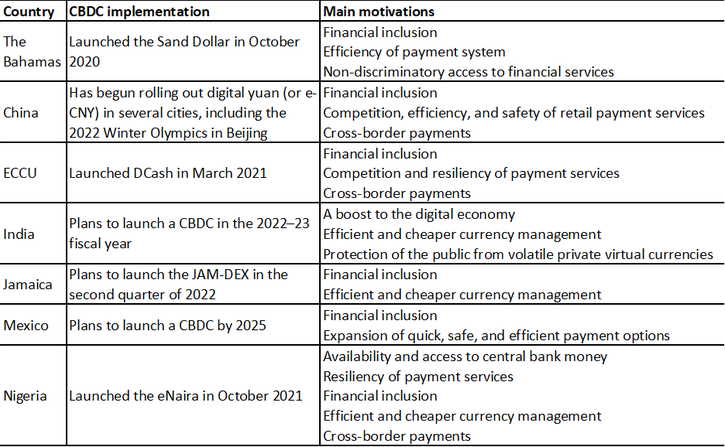

Retail CBDCs in emerging markets and developing economies (EMDEs)Central banks in many EMDEs view a retail CBDC as a viable solution to problems in their economies and payment systems. Table 1 shows that central banks in seven EMDEs have implemented or plan to implement a retail CBDC: the Bahamas, China, the Eastern Caribbean Currency Union (ECCU), India, Jamaica, Mexico, and Nigeria.

Note: Motivations are listed in the order they are given in the respective central banks’ papers, speeches, or press releases.

Sources: Central Bank of The Bahamas (2019), People’s Bank of China (2021), Eastern Caribbean Central Bank (2021), Shankar (2021), Bank of Jamaica (2021), Rodríguez (2022), and Central Bank of Nigeria (2021).

Although policy goals for a retail CBDC vary by country, Table 1 shows a few common motivations include promoting financial inclusion; enhancing payment system efficiency, competition, security, or resiliency; and improving cross-border payments. These motivations are consistent with unique challenges of EMDEs relative to advanced economies. In EMDEs, many consumers lack access to financial services, rely heavily on cash, and tend not to use electronic payment systems, which are often less developed....

....MUCH MORE

The reminder that this had flashed across the screen:

The “data artist” takes a closer look at why all cbankers studying CBDCs are fascinated by the Bahamian sand dollar pilot. https://t.co/rrKhUpltAZ

— Izabella Kaminska (@izakaminska) May 31, 2022