Additionally the oft-delayed balance-sheet reduction plan looks downright feeble, $47.5 billion per month in June, July and August.

From ZeroHedge:

"Inflation is much too high," warned Fed Chair Powell in his opening words, in an effort to assure the American people - and the markets - that they are really really serious this time, pinky-swear, about hiking even if the market pukes its guts out... (or not).

The market did not like that news (stocks fell, yields rose, rate-hike-odds rose)

But then Powell tried to assuage fears of a 75bps hike:

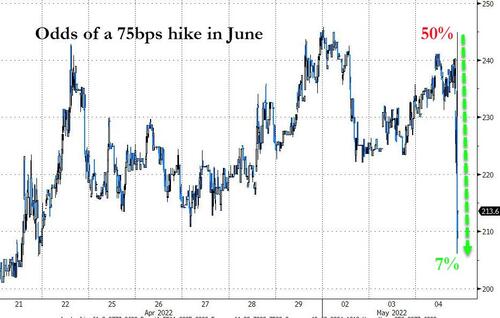

"A 75 basis point increases is not something the committee is actively considering," but noted that the "next couple of meetings" will be 50bps hikes.

The market loved that news (stocks surged, USD dumped, yield curve steepened with short-end yields plunging).

STIRs immediately priced-out the odds of a 75bps hike in June...

Source: Bloomberg

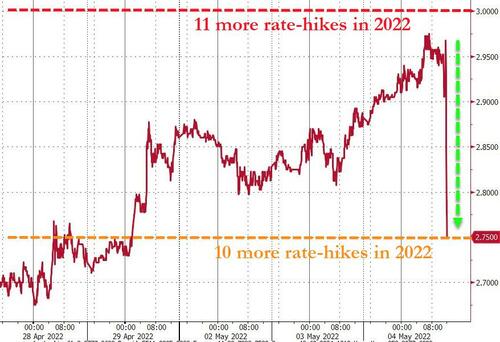

And the rate-hike-trajectory also dropped on Powell's more dovish tilt...

Source: Bloomberg

The short-end of the yield curve collapsed (2Y -13bps, 30Y -2bps)...

....MUCH MORE