David Stockman (OMB; Solomon, Blackstone) pulls no punches in this analysis of what we are doing to working stiffs.

From Brownstone Institute, April 30:

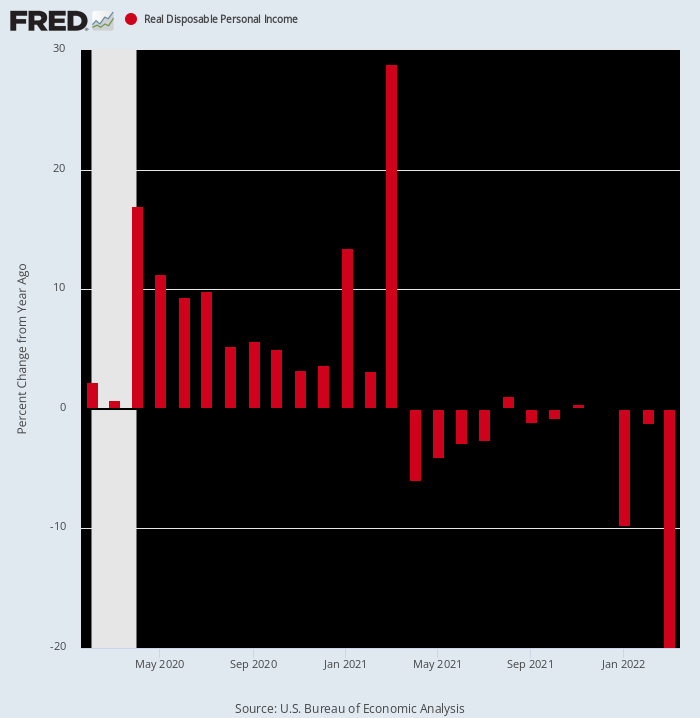

Well, here’s another shocker. This Commerce Department report showed that real disposable personal income in March came in at -19.9% versus March 2021.

That staggering shrinkage, of course, is still another testimony to the old saw about “what goes around, comes around.” That is, last March real disposable incomes soared by nearly 29% owing to the massive Biden stimulus payments. But since then inflation has blasted skyward, even as Washington has run out of nerve on the fiscal stimulus front.

Y/Y Change In Real Disposable Income, February 2020 to March 2022

What this reminds, of course, is that we are not in an ordinary business cycle. Washington simply went berserk on the fiscal and monetary front in response to the economic dislocations caused by Trump’s foolish backing of Covid lockdowns. These massive stimmy eruptions, in turn, have created unprecedented turmoil and fluctuations in the quarterly flows of income and spending.

And, yes, the Donald owns the Lockdown madness of 2020, which caused GDP to plunge at a 37% annual rate during the April-June quarter of that year. After all, no one said he had to listen to the likes of statist bureaucrats such as Dr. Fauci and the Scarf Lady, but he was simply too uninformed, lazy, and timid to send them packing.

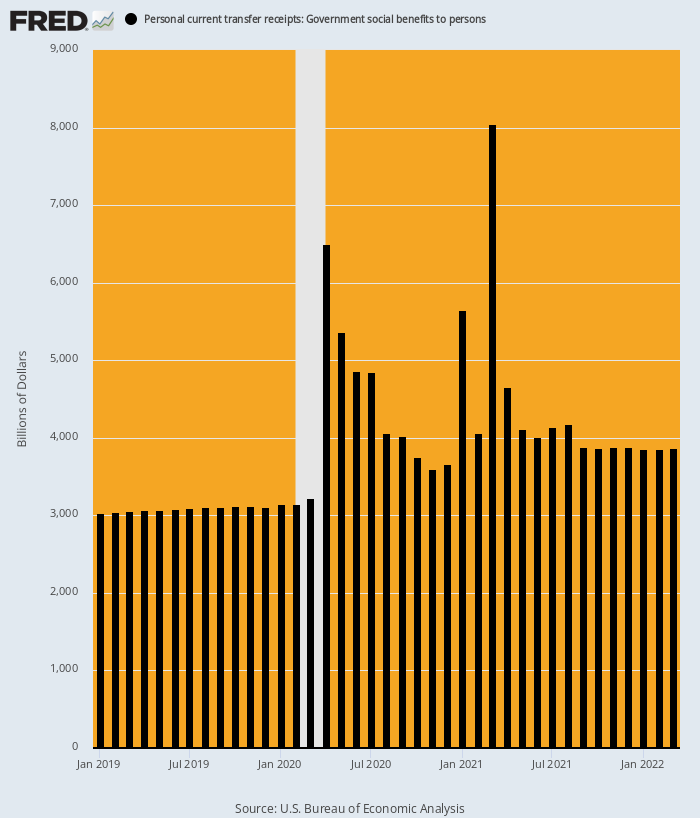

In any event, there has never in American history been an explosion of transfer payment free stuff like occurred on the Donald’s watch during 2020 and Q1 2021. And, yes, you can saddle him with a good share of the blame even for Biden’s $1.9 billion spending palooza in March 2021. That’s because it was centered on completing the second $2,000 per person stimmy check that the Donald had loudly brayed for during the 2020 election campaign.

As shown below, the annualized run rate of total government transfer payments (including the state and local portion of welfare and Medicaid) had been about $3 trillion, but after February 2020 it soared into a wholly different zip code. Thus, compared to the $3.15 trillion rate of February 2020, the huge surges of transfer payments occurred as follows:

- April 2020: $6.49 trillion, up 106%;

- January 2021: $5.65 trillion, up 79%;

- March 2021: $8.05 trillion, up 155%.

Alas, even Washington’s outbreaks of fiscal madness eventually come to an end. Consequently, the run rate of transfer payments reported this morning for March 2022 was just $3.86 trillion, a figure -$4.19 trillion and 52% below that of March 2021.

Needless to say, neither the American economy nor economists’ models are built to handle fluctuations of such gigantic magnitudes. Accordingly, the American economy is now flying blind into a direction which includes soaring inflation and an abrupt reversal of the massive monetary and fiscal stimulus that drastically distorted economic activity during the past two years.

Total Government Transfer Payments At Annualized Rates, January 2019 to March 2022

For the moment, the collapse of stimmies and transfer payments has not appreciably slowed down the every-ready spending bunny of the household sector. During March, spending rose by 1.1% from February and was up by 9.1% from prior year.

But that only happened because households took their savings rates back to 6.2% of disposable income—the lowest level since December 2013, and barely half of the 10%-12% rates that prevailed prior to the turn of the century.

Stated differently, the temporary bulge in the calculated savings rate which occurred during April 2020 to March 2021 was a pure artifact of Washington’s fiscal madness: Free stuff was being shoved into household bank accounts faster than even America’s spendthrift families could dispose of it.

But for all practical purposes that is now ancient history. The household sector is already back to its paycheck-to-paycheck modus operandi, meaning that when the next round of layoffs hit the scene, it will pass directly through to reduced consumption spending....

....MUCH MORE

What an absolute, foreseeable, nay warned against, mess