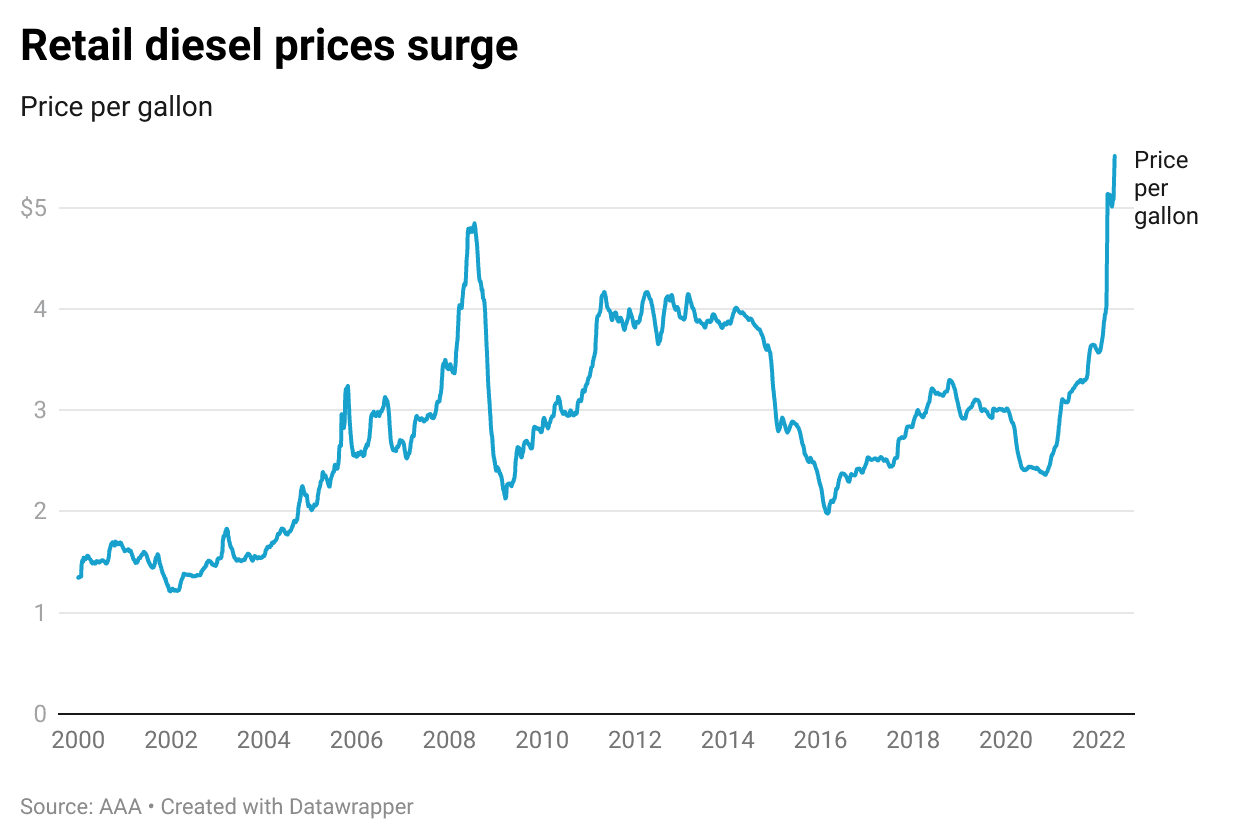

Yesterday CNBC published "Diesel fuel is in short supply as prices surge — Here’s what that means for inflation" which among many other things included this handy chart:

Regarding the star of the below post, Phil Verleger, I mentioned in 2013:

I have very mixed feeling about Mr. Verleger.....

The negatives included a couple really bad price predictions and and almost gaudy self-promotion. The positives were the respect of some people who know the hydrocarbon markets.

And from FreightWaves, April 30:

Along with the pain of higher prices in general at the pump, truck drivers are dealing with the fact that diesel has risen beyond increases in crude and gasoline.

The numbers are stark on how much diesel has risen relative to other benchmark oil prices in recent weeks. According to the Department of Energy’s Energy Information Administration (EIA), retail gasoline is up 26% from the start of the year — but diesel is up 42.8%.

While it’s easy to blame the Russia-Ukraine war, given the enormous role of Russia as a supplier of diesel, the reality is that the price of diesel compared to crude and gasoline began to increase well before Russia’s invasion.

The price that truckers pay at the pump always is determined primarily by the price of crude. But if the relationship between crude and diesel goes through structural changes that tack on another 10 to 15 cents a gallon to the spread, those gains are going to impact the retail price of diesel even if crude sits perfectly still.

Just how much has that spread widened? The accompanying chart shows the spread between retail gasoline and retail diesel, according to the average price published each Monday by the EIA.

For the diesel-consuming industry, this price isn’t some abstract figure popped out by the government; it’s the basis for most fuel surcharges. A year ago, that spread was just under 40 cents a gallon. Based on the most recent prices published Monday, the spread is now about $1.20 a gallon.*****But the retail price is at the end of a long supply chain that includes crude production, selection of types of crudes for a refinery to process, and the split in refinery output among gasoline, diesel, jet fuel and other products. That growth in the gasoline-to-diesel retail spread ultimately is the final step after changes in the spot products market.On Monday, the simple spread on the CME commodity exchange between the front month Brent crude price and that of ultra low sulfur diesel was $1.65 a gallon. Part of that number reflects this week’s squeeze in the diesel market. With the May contract on CME heading toward expiration Friday, traders with short positions needing to close out their trade before the end of the week found barrels scarce. So it is a one-off that will come to a conclusion before Friday.

Even if numbers from this week are loosely ignored as having been caused by those unique circumstances, it’s hard to overstate just how out of whack the spreads between diesel and Brent crude have become.

The spread crossed the $1-a-gallon mark on March 18. At the start of 2022, it was about 47 cents. For all of 2021, the spread averaged less than 40 cents. (Brent is the preferred benchmark for comparison because it is the global crude benchmark and diesel is traded globally as well.)

These movements obviously are not all driven solely by the Russia-Ukraine war. So what is happening?

Philip Verleger is an energy economist who has diesel in his sights. For example, in the spike to what remains the all-time-high crude price — $147 for West Texas Intermediate at the beginning of July 2008 — Verleger was unique among analysts in citing changes in diesel specifications as the tail wagging the dog. Diesel was dragging up crude, Verleger argued, not the other way around.

Verleger: Structural changes in the diesel market are boosting prices

In a recent report, Verleger makes a similar argument. He sees the biggest difference as the structural changes in the market, many of them related to government mandates, having permanently altered the diesel market into a situation where traditional spreads between crude and diesel, and diesel and gasoline, have disappeared and won’t be returning. (Addendum: Nothing in the oil market is truly permanent, so it’s a relative term.)

In his report, Verleger lays out five basic facts about diesel’s chemistry, which is key to understanding why its supply has tightened so much and why its price has climbed well beyond increases in crude and gasoline.

Two factors Verleger cites are well known: Refining oil produces a level of diesel that is a percentage of output but which structurally can’t be easily increased; and that each crude has its unique chemistry that produces varying yields of diesel and other products.

But Verleger also cites lesser-known factors.....

....MUCH MORE