From ZeroHedge:

Moments ago we reported that for the first time in US history, gasoline in every single state is above $4/gallon, while the national average US retail gasoline price just topped $4.50 a gallon today, also for the first time. That’s up about 50 cents from a month ago, and a massive jump from $3.04 per gallon on the same day in 2021. While shocking, in just a few months, these numbers may seem quaint and quite low.

With expectations of strong driving demand — the US summer driving season starts on Memorial Day, which lands this year on May 30, and lasts until Labor Day in early September — JPMorgan's commodity strategist Natasha Kaneva warns that US retail prices could surge another 37% by August to a $6.20/gal national average.

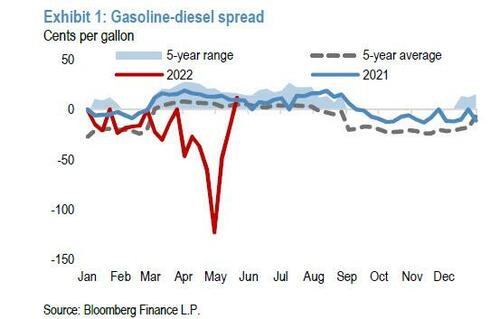

How is this possible? Well, as peak US summer driving season begins, record diesel pieces are about to take a back seat to gasoline. Toward the end of April, as the May NYMEX diesel contract climbed into expiry, US diesel prices peaked at a $1.63/gal premium to US gasoline, the highest diesel premium ever. Over the following two weeks, US gasoline prices climbed to close that gap and today gasoline is trading at a 15 cents per gallon premium to diesel

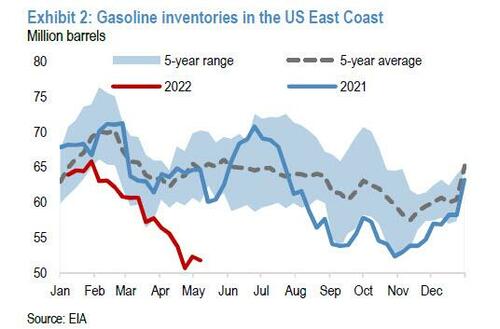

Why does this matter? As Kaneva explains, typically, refiners produce more gasoline ahead of the summer road-trip season, building up inventories. But this year, since mid-April, US gasoline inventories have fallen counter seasonally and today sit at the lowest seasonal levels since 2019 (thank diesel production). Gasoline balances on the East Coast have been even tighter, drawing to their lowest levels since 2011.

It's not just diesel: thank a rush to export US energy output too.

According to JPM, a major driver in these counter-seasonal draws in gasoline is higher-than-normal exports. Preliminary EIA data suggest that gasoline exports, mostly to Mexico and the rest of Latin America, are averaging about 0.9 mbd since March, about 100

kbd above seasonal norms and nearly 300 kbd above summer rates.The punchline: if exports persist at this elevated pace and refinery runs, already near the top of the range for reasonable utilization rates, fall within JPM's expectations, gasoline inventories could continue to draw to levels well below 2008 lows and retail gasoline prices could climb to $6/gal or even higher, according to JPMorgan.

Some more details from the JPM forecast, starting with assumptions:...

....MUCH MORE

Had to adjust the ZH headline as natural gas prices are already at $8.30 on the most active futures.