Following on last night's "Oil Prices: Will Shanghai Re-Open?".

From OilPrice via ZeroHedge:

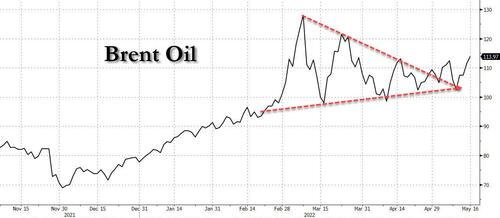

Oil prices have topped $113 per barrel on optimism that China’s lockdowns are coming to an end and demand will not take a prolonged hit.

In early afternoon markets Monday, news that Shanghai was seeing a strong recovery from COVID cases, with plans in place to ease lockdown restrictions beginning this week, outweighed a litany of bearish news for oil.

Brent was at $113.97 per barrel on 3:20 pm EST, while WTI was trading at $113.77.

WTI neared $115...

Authorities in Shanghai on Monday said restrictions would finally ease, in stages, after nearly six weeks of lockdowns that have shaken the Chinese economy and disrupted global supply chains.

On 1 June, Shanghai is scheduled to see lockdowns end, with a gradual easing beginning on May 21st.“From June 1 to mid- and late June, as long as risks of a rebound in infections are controlled, we will fully implement epidemic prevention and control, normalise management and fully restore normal production and life in the city,” the Guardian quoted deputy mayor Zong Ming as saying Monday.

The announcement comes shortly after downward pressure was put on oil prices over new releases of weak Chinese economic data and signals that the European Union’s plans to ban Russian oil had faltered....

....MORE

That first chart is an almost perfect pennant formation, from which 10% moves (either direction) are common after the direction (up/down) is resolved.

Now, if we can get Poland + Lithuania to enter Ukraine next week we'll see if that 10% can become 50%.