In the post immediately below: Class War: Fed Governor Lael Brainard On "Variation in the Inflation Experiences of Households", I chose to focus on the hugely disparate impact of inflation on high and low income earners. However, in the same speech Governor Brainard addressed the Fed's balance sheet by saying, among other things:

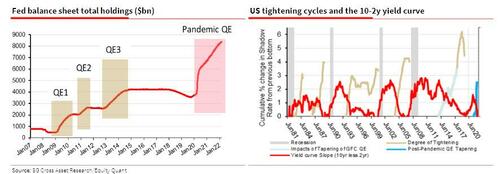

"Against that backdrop, I will turn to policy. It is of paramount importance to get inflation down. Accordingly, the Committee will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting. Given that the recovery has been considerably stronger and faster than in the previous cycle, I expect the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017–19. The reduction in the balance sheet will contribute to monetary policy tightening over and above the expected increases in the policy rate reflected in market pricing and the Committee's Summary of Economic Projections. I expect the combined effect of rate increases and balance sheet reduction to bring the stance of policy to a more neutral position later this year, with the full extent of additional tightening over time dependent on how the outlook for inflation and employment evolves."

Brainard is the most dovish of the Governors, and for her to be talking like this the Board has to be very concerned they've let inflation run too wild. The unwinding of the balance sheet is the more powerful of the two tools the Fed is using, in particular the effect of letting Agency paper run off on mortgage rates, which have already almost doubled off the recent record lows. The slowdown in the household furnishings sector will be one indicator to bear in mind, and again, it is already anticipating the balance sheet moves that won't even begin until next month.

....Indeed, while the prevailing hawkishness across the FOMC means monetary policy will be tightened faster than expected, a third question is how much faster, or in other words, "what is the trade-off between QT and higher Fed Funds? Surely the faster the balance sheet is shrunk, the fewer rises will be needed in Fed Funds."According to at least one Wall Street strategist, the answer to these questions is also the reason why the Fed Funds rate won't climb beyond 1.0%!

We refer to SocGen's resident permaskeptic, Albert Edwards, who today writes that "the prospect of the Fed engaging in rapid balance sheet shrinkage (QT) has spooked the markets." But, as we muse above, how does one combine the concurrent impact of QT with the Fed Fund hikes to get a handle on where Fed Funds might peak?

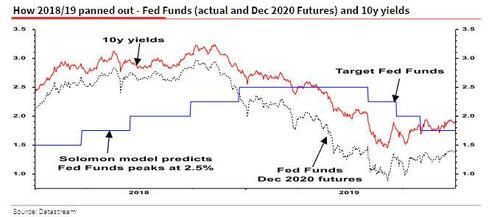

Well, Edwards believes he may have the answer, or rather he says that his "learned colleague", SocGen's in house quant guru Solomon Tadesse has an answer. While few in the mainstream have ever heard of Solomon, back in mid-2018, not long before the Fed's rate hike plans blew up spectacularly, the SocGen quant made waves on Wall Street trading desks when he went against the consensus view, and in May 2018 pinpointed the peak in Fed Funds at a lowly 2½%. He was absolutely spot on.

The problem: his latest analysis for this cycle puts the peak of the Fed Funds at just below 1.0%, or less than 3 more rate hikes before the Fed is forced to reverse! That, as Edwards notes, "is so far away from the current consensus that it deserves some serious analysis."

* * *

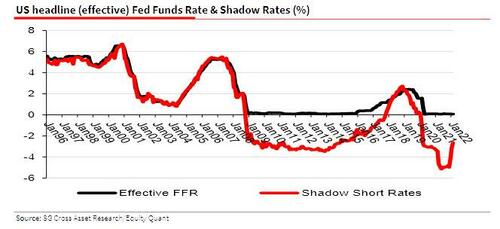

First, for those curious about the details some background: Solomon’s explanation of the first generation Shadow FFR based on Wu and Xia (2016) and his second generation estimate from De Rezende and Ristiniemi (2020) are in this note here. For those pressed for time, what the analysis says is that the pace of QE or QT can be combined with the headline Fed Funds rate to calculate a Shadow FFR.

So combining the expansion of the Fed’s balance sheet from sub-$4 trillion at end 2018 to almost $9 trillion was the equivalent of the FFR falling to minus 5% (charts below)! But now that the Fed has reveresed, ending QE combined with just one ¼% hike in the headline FFR means the Shadow FFR has already jumped from minus 5% to minus 2.5% – a 250bp hike (blue line below).

We now take a brief tour down memory lane to remind readers how when Solomon made his mid-May 2018 call that the FFR would peak at 2½%, the market was looking at something nearer 3% (see chart below). Not much difference you might think, but as the Fed enacted its final hike to 2½% in Dec 2018, expectations of easing were rapidly taking hold as investors realized that the Fed had clearly overdone the tightening cycle (as we had said previously, the Ghost of 1937 has emerged right on schedule and the Fed has overtightened) even though just back in October 2018, Powell said that "we are a long way from neutral."

Meanwhile, as Edwards reminds us, the US bond rally from mid-Nov 2018 onwards was typical of the situation when yields tend to peak before the last rate hike. By comparison, currently the market expects the Fed to tighten rates rapidly and the peak in the FFR to be close to 3½% by March 2023.....

....MUCH MORE, the sting as they say is in the tail but the ZH introduction is quite good for getting the lay of the land.