From Philip Pilkington's Macrocosm substack, April 18:

And what does it predict about future inflation?

Last week the CPI numbers were released in the US. They weren’t great. It feels that markets are starting to consider the prospect of inflation continuing to rise.

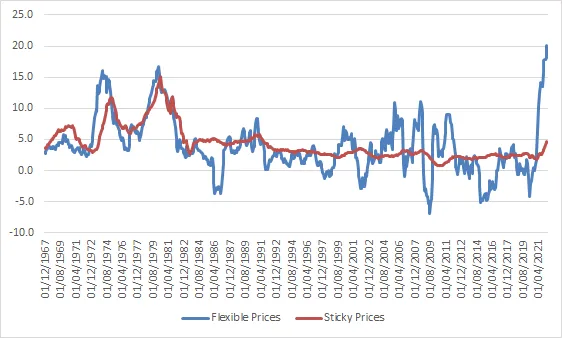

One interesting feature of last week’s data release is the impact that it had on the Atlanta Fed’s sticky/flexi price CPI index. Here is the full series from the Atlanta Fed.

As we can see, until recently, inflation only seemed to be taking place in flexi price markets. These are mostly goods that have volatile prices and are priced on markets driven by supply and demand. Think: energy, used cars, food etc — all the stuff that took a big hit due to the lockdowns and the Russian invasion of Ukraine.

But in recent months, sticky prices have started to respond. These are the prices end consumer typically see at the checkout. These prices are typically ‘administered’ by corporations and set, not in line with supply and demand, but strategically in order to maximise sales and not alienate consumers. They are also the prices that spur consumers to demand wage hikes — and that can, as we noted before, trigger a dreaded wage-price spiral where inflation becomes entrenched.

In this post I’m going to do two things. First, I am going to look at the reliability of the Fed’s metric for forecasting purposes. Secondly, I’m going to use it to predict future sticky price inflation....

....MUCH MORE