From Debt and Foreign Policy, May 29, 2019:

How much should one pay for Russian currency risk?

Apparently, if you ask buyers of Russia’s latest sovereign Eurobond issuances, the answer is somewhere between zero and 20 basis points.

I was inspired to write this by this Twitter thread, which was in turn in response to an article from Bloomberg quoting Konstantin Vyshkovsky, head of the public debt and financial assets at the Ministry of Finance, saying that “the presence of foreigners in our market gives us a certain degree of protection… (Russia’s integration into the global financial system) affects the probability that foreign governments will impose sanctions against Russia.’’ In other words, Vyshkovsky claims Russia is selling new Eurobonds solely to try to mitigate the risk that the US and UK will pass proposed legislation banning Russian sovereign debt issuances. The argument is simple, Western investors holding them, they would have an incentive to lobby their governments not to ban Russian debt.

But this is only half true. Yes, Russian Eurobonds have found renewed favor with Western investors, despite the sanctions environment. But the US sanctioned Venezuelan debt just this year, although such debts are predominantly held by US investors. There is also bad precedent in Russia, albeit admittedly from way back when (1877), when Chancellor Otto von Bismarck banned Russian government debt issuance in Germany although german banks were its lead underwriters in previous years.

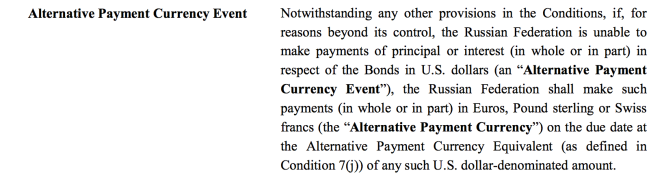

The real reason Russia is selling more debt, and buying up old eurobonds and that its new bonds contain something pretty novel to the world of sovereign debt, “alternative payment currency event” triggers.”

So what are these triggers? Well I am glad you asked (or read this far).

After a three-year hiatus Russia returned to Eurobond markets in 2016. This came after markets calmed somewhat following the introduction of US sanctions and oil price collapse of 2014-15. Here is the alternative payment currency event wording from 2016.

Seems rather innocuous.....

....MUCH MORE

HT: New Wayland