"*Not."

From The Neue Zürcher Zeitung's The Market.ch, April 4:

Financial markets have largely priced in the Russian invasion into Ukraine. Some asset classes appear attractively valued – but not attractively enough.

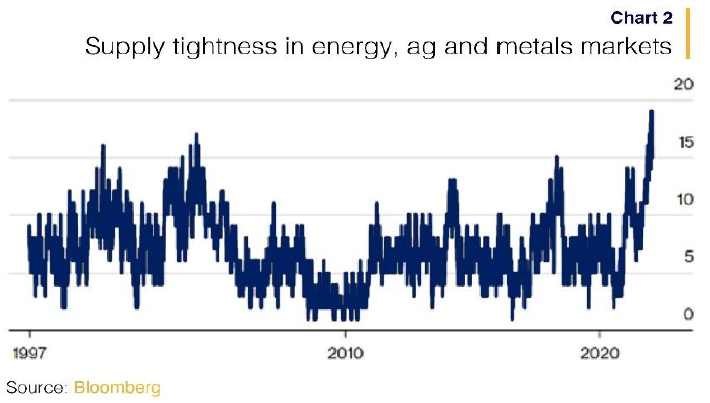

Chart 1 shows the GSCI index has risen nearly threefold since its March 2020 nadir. According to Bloomberg, a record number of commodity contracts are in backwardation (Chart 2 below).Markets have stabilized since the Russian invasion, and the sequence of surprise escalations we saw a few weeks ago has slowed. Our best guess is that the war will be long and drawn out. However, we’ll spare you the amateur geostrategy and focus instead on a few financial market observations.

The commodity bull market is just getting going

It’s interesting to note, especially given the attention the move has drawn, that the real return to commodity investors since 2000 has been roughly 1% (Chart 3), the downturn post GFC completely unwound the prior bull run of the early 2000s (such are the dangers of commodity investing). In other words, we could be at a good starting point for a commodity bull market....

....MUCH MORE

Now Mr. Grice is hanging his hat at Calderwood Capital (co-founder) and writing at The Market.ch,

Previously from Mr. Grice via The Market.ch:

March 4, 2021

Dylan Grice: "Central Banks are Going to Overcook the Economy"

March 15, 2021

Dylan Grice: "The Bubble is Just Beginning"

February 13, 2021

The Stage is Set for a Bull Market in Oil

Finally, from February 18, 2021, the essence of what I know about commodities

Commodity Supercycle Or Not?

The key to cycles in commodities from extractive industries - oil, gas, metals - is investment while the key in agricultural commodities are the substitution effects at both the producer - does farmer Brown expect more profit from corn or wheat - and the consumer - chicken or steak - levels....

"From Boom to Bust: A Typology of Real Commodity Prices in the Long Run" Plus a Compendium of Dylan Grice at Société Générale, 2009-2012