Mr. Richter is using a somewhat unorthodox methodology to make his point(s).

First off, European stocks are down a lot.

Although unspoken, his presentation also makes the point that prices were really, really high in 1998 - 2000.

From Wolf Street, March 6:

Food for thought in light of the biggest stock market bubble in the US ever.

Major European stock indices plunged below their bubble highs from over two decades ago. This is not to say that they plunged that much this week, but that they had finally risen past their prior bubble highs from over two decades ago, powered by money printing, and then they plunged.

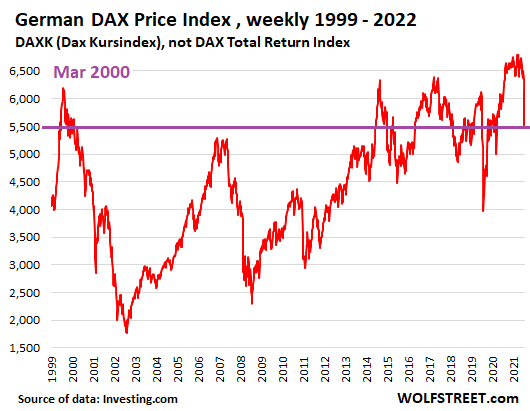

German stocks. The most widely cited German stock market index, the DAX, is a total return index that includes dividends and is therefore not comparable to a price index such as the S&P 500 Index, which does not include dividends. But the less-often cited DAX Kursindex (DAXK) is a price index, and does not include dividends, and is comparable to the S&P 500 Index and most other major stock indices. So that’s what we’ll use here.

The DAXK plunged by 4.4% on Friday, and by 10.1% for the week, to 5,517. Since the all-time closing record of 6,873 on January 5, 2021, it plunged 19.7%. But wait… that all-time closing high was up only 10% from the bubble high in March 2000 – yup, that bubble that imploded 22 years ago. And on Friday, the index closed 11% below the bubble high of March 2000. Note the gigantic volatility investors went through over these 22 years to end up below where they’d started....