It would go a long way toward addressing his biggest political liability, the inflation that people see every time they buy gasoline and it would more directly threaten Russia than the convoluted re-routing of hydrocarbon flows across Eurasia to China and across the Atlantic to the U.S that sanctions create.

Enter Iran, stage right.

From Philip Pilkington's Macrocosm substack, February 24:

Earlier this week I wrote a piece for UnHerd arguing that sanctions would be largely ineffective against Russia — at least, from a macroeconomic point-of-view. In that piece I argued that the only way that the West could ‘punish’ Russia for an invasion of Ukraine would be to bring oil prices down. Now that the invasion appears to be happening, it is worth following up on that as the implications for market are obviously profound.

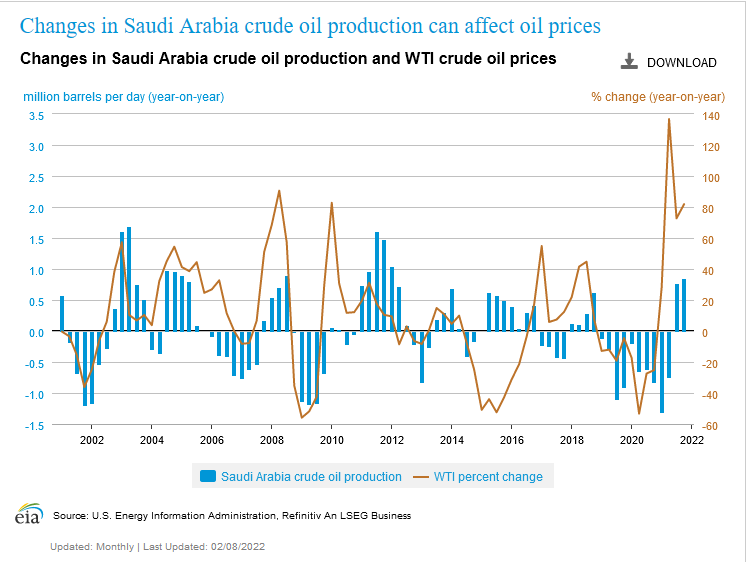

The first question is this: is it true that the West crashed the oil price in 2014 when tensions in Ukraine began? This claim was widespread at the time (see also: this). Looking at the data, it is impossible to tell. But there are some indications that the claim may have some merit to it. Here is Saudi oil production versus the oil price:

First off, note that they are somewhat correlated. More on that in a moment. Note that the Saudis do ramp up oil production in the first quarter of 2014 (the Ukrainian-Russian conflict kicked off in February 2014). This increase in Saudi production — which may or may not have been requested by the United States — seems to precipitate a collapse in the oil price.

But when we zoom out, it doesn’t look like they increased production all that much. That said, it is possible that the oil market was fragile at the time. To understand this, lte’s build a model that tries to explain the oil price. We’ll keep things simple enough....

....MUCH MORE

If this is doable there are three geopolitical problems that would have to be dealt with:

1) Iran will continue their nuclear arms and ballistic missile programs regardless of any piece of paper they sign which will pretty much guarantee a reaction from either Israel or Saudi Arabia or both.

2) Russia may feel provoked into war with the U.S. in the same way Japan felt provoked into war by Roosevelt in the early 1940's:

Finally this would push Saudi Arabia and the Gulf States closer to China. Reuters, March 3:....In 1939, the United States terminated the 1911 commercial treaty with Japan. "On July 2, 1940, Roosevelt signed the Export Control Act, authorizing the President to license or prohibit the export of essential defense materials." Under this authority, "[o]n July 31, exports of aviation motor fuels and lubricants and No. 1 heavy melting iron and steel scrap were restricted." Next, in a move aimed at Japan, Roosevelt slapped an embargo, effective October 16, "on all exports of scrap iron and steel to destinations other than Britain and the nations of the Western Hemisphere." Finally, on July 26, 1941, Roosevelt "froze Japanese assets in the United States, thus bringing commercial relations between the nations to an effective end. One week later Roosevelt embargoed the export of such grades of oil as still were in commercial flow to Japan."8 The British and the Dutch followed suit, embargoing exports to Japan from their colonies in Southeast Asia.

Roosevelt and his subordinates knew they were putting Japan in an untenable position and that the Japanese government might well try to escape the stranglehold by going to war. Having broken the Japanese diplomatic code, the American leaders knew, among many other things, what Foreign Minister Teijiro Toyoda had communicated to Ambassador Kichisaburo Nomura on July 31: "Commercial and economic relations between Japan and third countries, led by England and the United States, are gradually becoming so horribly strained that we cannot endure it much longer. Consequently, our Empire, to save its very life, must take measures to secure the raw materials of the South Seas."9....