Phillip Pilkington at his Macrocosm substack:

The ECB backstop in a rising rate environment

Last week ECB President Christine Lagarde told investors that she could not rule out interest rate hikes this year. Her language was hardly Volcker-era fire and brimstone. Nevertheless, European government bond markets paid attention.

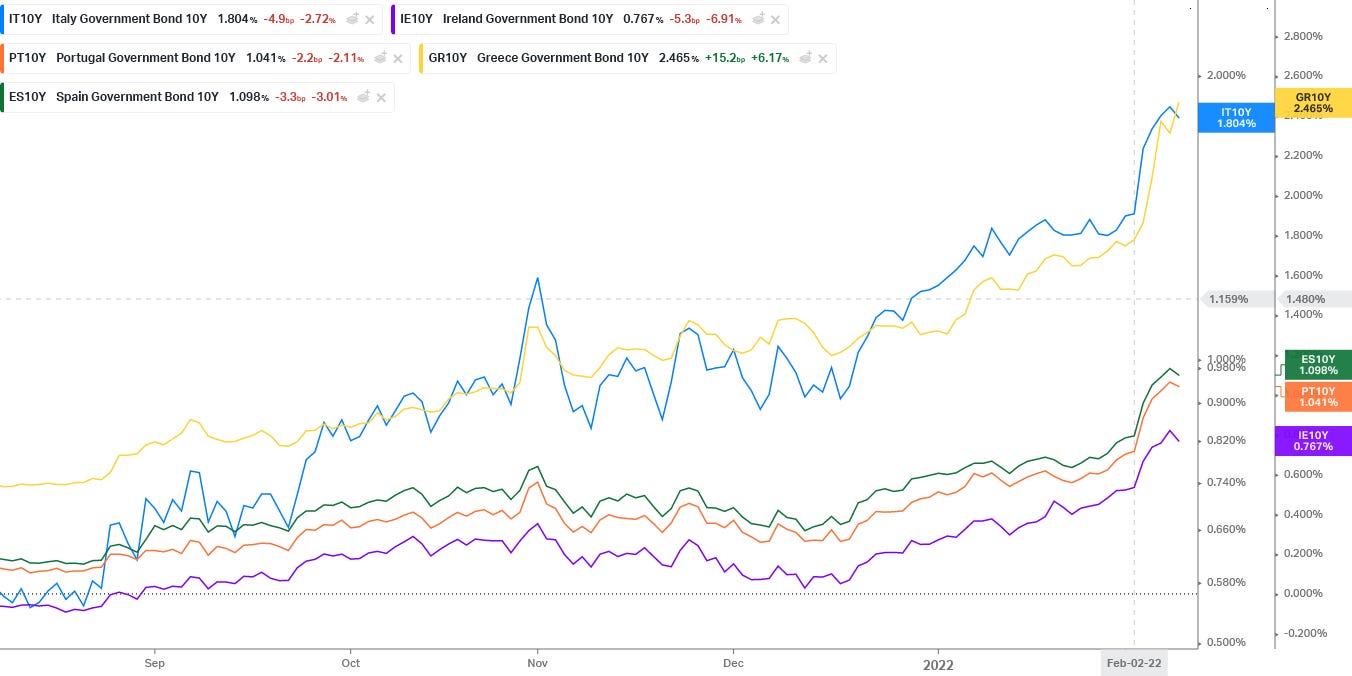

Below are the yields for the 10 year bonds of the old PIIGS countries. The vertical dotted line highlights the meeting.

[Should Ireland still be grouped with the southern European countries?]

As we can see, the price action has been pretty dramatic across the board — but especially so in Italy and Greece.

Now, rising interest rates are not in themselves problematic. But recall that the European bond markets were stabilised by an implicit ECB backstop. The word implicit should be highlighted here. The ECB never made the backstop of government bonds official policy. Rather it was communicated with a wink and a nod by Mario Draghi in a 2012 speech....

....MUCH MORE