Two from ZeroHedge:

Thursday, Feb 24, 2022 - 04:40 PM

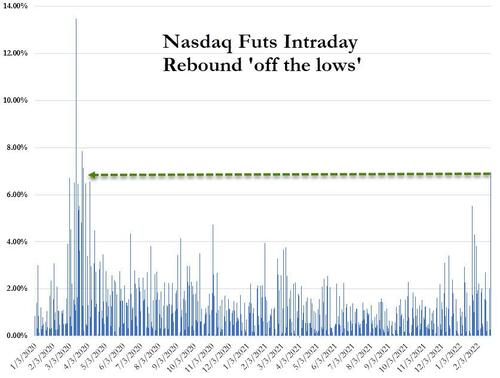

As we noted earlier, today's stunning rebound in stocks (most notably Nasdaq, which swung from down 4% overnight to close up 3%)...

...was the biggest intraday rebound since The Fed 'saved the world' in March 2020.

The reversal began at the US cash market open, stalled a little, then exploded higher after President Biden's sanctions speech was not as harsh as feared.

The question is - WTF Happened!!!

We offered some preview hints on Tuesday when we noted that market sentiment has barely ever been worse and everyone is hedged-and-wedged...

....MUCH MORE

And earlier:

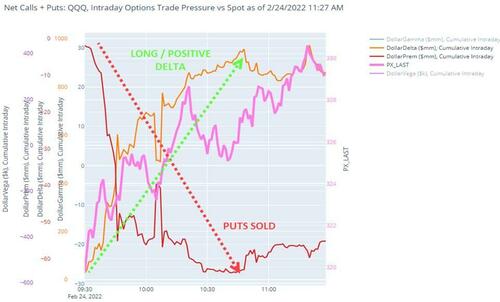

Update (1300ET): In case you were wondering just who (or what) was BTFDing today, Nomura's Charlie McElligott can clear things up for those chasing the momo here.

Equities' move off the lows is largely a function of “Long / Positive Delta” expressions in the options space (as opposed to “wholesale” uptick in risk-appetite - although there is def some offense being played).

Primarly, index / etf downside hedge monetization (see below) and VIX upside CS monetization , in addition to some “offense” with upside prem spent, largely via Call Spreads.

Collecting premium from selling QQQ Puts equals positive deltas...

So, it's hedge unwinds, not optimism that is driving this and as McElligott warns, this may leave us open to pullback thereafter unless flows sustain.

And for now, we just can't break away from unch for Nasdaq (with The Dow still down pretty hard)...

....MORE

Either way though it is probably worthwhile to know what he is telling people.